Table of contents

Introduction

Steel prices decide project costs more than any other material. For MSMEs, the rate of TMT bars is not a small detail. It can influence profit margins, working capital, and the chance of winning a tender. A sudden change in the Agni TMT steel price can alter the course of an entire project.

Why market rate is only part of the story

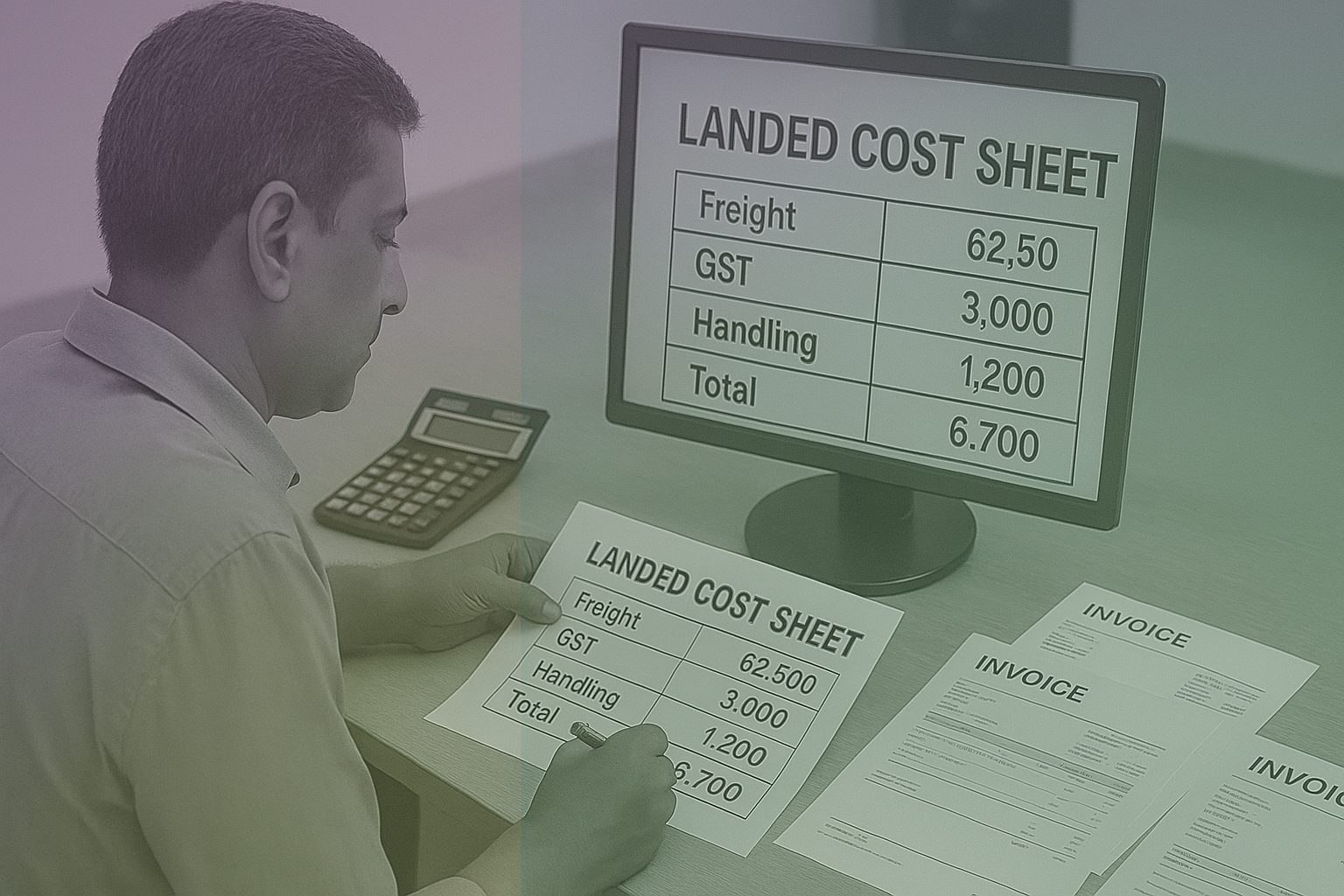

Most websites show a daily rate per kilogram or per ton. These numbers are easy to find, but they tell only half the truth. The actual bill is shaped by transport charges, GST, unloading costs, and minimum order conditions. A dealer may offer one rate in Tamil Nadu, yet the same order in Rajasthan will carry a much higher landed cost once freight and taxes are added.

Why MSMEs need a deeper view

For smaller contractors, missing these details can mean quoting too low in a bid or falling short on cash once work begins. A reliable guide must explain not only the base price but also how logistics, compliance, and financing affect the final cost. This article takes that approach, giving MSMEs a practical way to plan their steel purchases.

Agni TMT steel price today

As of early 2026, Agni TMT steel is quoted per kg or per ton, with South Indian dealers, especially in Tamil Nadu, listing rates around ₹72–₹75 per kg, depending on size. Smaller diameters like 8 mm and 10 mm tend to be slightly higher per kg due to handling and transport costs, while larger sizes such as 16 mm and 20 mm are generally priced a bit lower.

Regional differences

Rates published online may seem uniform, but actual delivery costs now vary even more. For instance, base rates in Coimbatore or Chennai may still look lower, but once you factor in freight, GST, and handling, the landed cost in distant markets like Jaipur or Delhi can be 8-12 percent higher. This gap can significantly affect MSMEs, especially those working on fixed-value contracts or supplying to government projects, because their margins are sensitive to such cost variability.

Why listed rates mislead

Many MSME buyers take the dealer’s list at face value. In practice, the billed rate often involves hidden elements that include unloading charges, delivery timelines, and even fuel surcharges. What if you ignore this? Then it will definitely lead to underestimation during project costing. And for buyers who are working on tight tenders, this gap between the listed and the landed cost can be risky.

Latest Agni TMT price (as of Early 2026)

Below is a sample of Agni TMT bar rate today for common diameters. These are market-indicative landed rates (excluding very remote logistics surcharges).

| Diameter (mm) | Approx. price per kg (₹) | Approx. price per ton (₹) |

| 8 mm | ~ 70–75 | ~ 70,000–75,000 |

| 10 mm | ~ 72–75 | ~ 72,000–75,000 |

| 12 mm | ~ 75–78 | ~ 75,000–78,000 |

| 16 mm | ~ 78–80 | ~ 78,000–80,000 |

| 20 mm | ~ 78–82 | ~ 78,000–82,000 |

| 25 mm | ~ 80–83 | ~ 80,000–83,000 |

*This price table for Agni TMT steel price is only for reference purpose. So, always cross-verify with your local dealers’ rates as costs vary with region, freight, and order volume.

Notes & context:

- These are market-based landed rates that don’t include extra charges for remote logistics but do include normal delivery and dealer margins for the area.

- Prices have mostly been in the same range since late 2025, but certain cities have seen small increases.

- GST (18%) and freight charges can add further to the final delivered cost.

- Online listings frequently show base catalogue rates (₹70-78/kg for common sizes). However, when you add in shipping and handling, the real cost to your project site may be ₹2-6/kg more.

Agni TMT regional price snapshots (Early 2026)

| Region | Quoted price (Indicative, early 2026) | Notes |

| Tamil Nadu/South India | 8 mm ~₹72–76/kg; 10–12 mm ~₹74–78/kg; 16 mm ~₹78–80/kg. | Based on prevailing dealer quotations in South India; final price varies by freight, order volume, and delivery distance. |

| Delhi/North India | ~₹74–79/kg (common diameters). | Dealer-driven pricing; variation depends on grade (Fe500/Fe550), stock availability, and logistics. |

| All-India (Agni brand – online/catalogue) | 8 mm ~₹72–75/kg; 10 mm ~₹74–76/kg; 12 mm ~₹75–78/kg; 16 mm ~₹78–80/kg. | Catalogue/advertised rates; GST (18%), freight, and dealer margins apply additionally. |

Market trends (Early 2026 updates)

- Prices remain broadly stable compared to late 2025 levels, with mild upward bias in select urban markets.

- Bulk project orders may secure ₹1–3/kg at lower negotiated rates depending on tonnage.

- Southern markets continue to show slightly firmer pricing due to steady construction demand.

Agni TMT buying guide – Early 2026 snapshot

| Diameter range | Indicative price (₹/kg) |

| 8–10 mm | ₹72–76 |

| 12–16 mm | ₹75–80 |

| 20–25 mm | ₹78–82 |

Final delivered price depends on city, order size, and freight.

Freight impact

| Delivery type | Typical freight addition |

| Metro/short haul | ₹2–4 per kg |

| Inter-state/long haul | ₹4–6 per kg |

| Remote project sites | May exceed ₹6 per kg |

Taxes & charges

- GST: 18% (standard nationwide)

- Local handling/market cess: Varies by state

- Unloading & site handling: Usually extra

Large project buffer recommendation

For government, EPC, or infrastructure contracts, keep a 8-12% buffer above base rate to cover:

- Fuel-linked freight spikes

- Delivery delays

- Batch/grade variation

- Site logistics charges

Best practices before ordering TMT steel

Always request a delivered rate quote specifying:

- Diameter (8–25 mm)

- Grade (Fe500 / Fe550)

- Total tonnage

- Exact project location

Landed cost factors MSMEs cannot ignore

The dealer’s rate is only one part of the expense. What matters to MSMEs is the landed cost – the amount paid when steel actually reaches the site. This includes base price, freight, GST, unloading, and even city-specific handling charges.

Common hidden elements

Freight is the most variable factor. A truck moving within Tamil Nadu may add just ₹1,000–₹1,500 per ton. The same truck carrying steel from Chennai to Jaipur can raise the cost by ₹5,000–₹6,000 per ton. GST at 18 per cent, unloading at ₹200–₹300 per ton, and fuel surcharges are other frequent add-ons.

Landed cost – city-wise (As of early 2026)

Example calculation for 12 mm bars

| City | Base price (₹/ton) | Freight & handling (₹/ton) | GST 18% (₹/ton) | Estimated landed cost (₹/ton) |

| Chennai | 76,000 | 1,500 | 13,680 | 91,180 |

| Bengaluru | 76,000 | 2,500 | 13,680 | 92,180 |

| Jaipur | 76,000 | 6,000 | 13,680 | 95,680 |

| Lucknow | 76,000 | 5,000 | 13,680 | 94,680 |

Values are indicative and change with fuel rates, truck capacity, and order volumes.

Notes (Early 2026 context):

- Base price reflects average dealer quotes for 12 mm Agni TMT in early 2026.

- Freight varies depending on proximity to primary distribution hubs (South India typically lower than North/West inland markets).

- GST remains 18% nationwide.

- Bulk orders (20+ tons) may negotiate ₹1,000–2,000 per ton lower base pricing.

Why this matters for MSMEs

For smaller firms, these variations can mean the difference between profit and loss. A contractor quoting based only on the base price may underbid in a tender. On the other hand, firms that plan with landed cost have stronger control over margins and fewer disputes with suppliers.

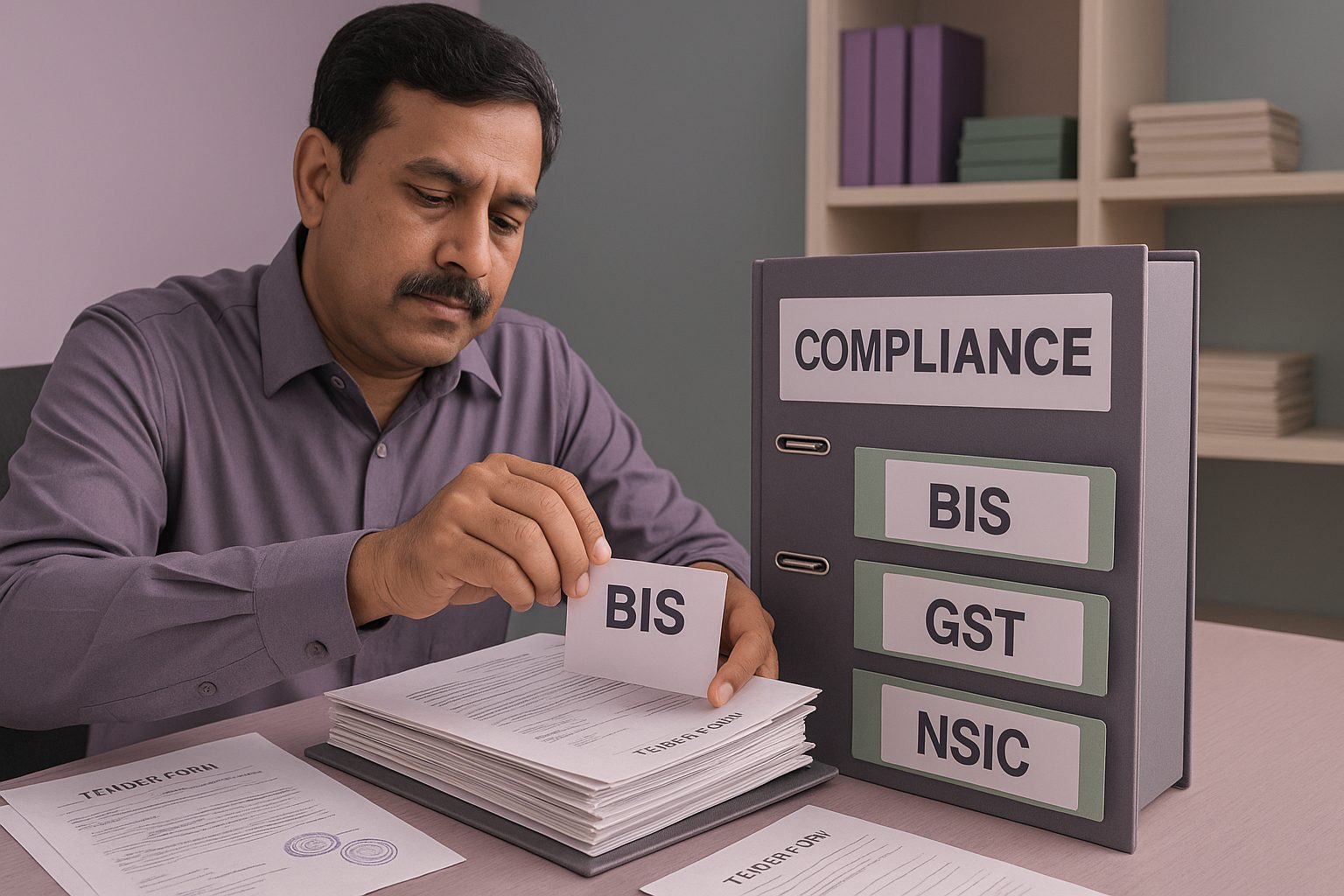

Procurement compliance and tender readiness

For MSMEs, buying steel is not only about price. Government and large private tenders demand strict paperwork. Missing even one certificate can delay payments or lead to outright rejection. Many smaller firms underestimate this risk until it costs them business.

Documents often overlooked

Tenders for construction and infrastructure projects usually require proof of IS 1786 compliance, valid Mill Test Certificates, and supplier GST registration. Some bids also ask for GeM registration, NSIC certificates, or BIS license numbers. MSMEs that fail to prepare these documents in advance face last-minute hurdles.

MSME compliance checklist

The table below shows the key documents and why they matter during procurement.

| Document / Requirement | Purpose in Tendering | Common MSME Mistake |

| BIS license (IS 1786) | Confirms steel grade meets Indian standards | Submitting expired or missing certificates |

| Mill Test Certificate (MTC) | Proves batch quality and chemical composition | Not verifying details against actual supply |

| GST registration | Required for invoice recognition and tax compliance | Using old or mismatched GST numbers |

| GeM registration | Mandatory for government supply contracts | Skipping registration until tender stage |

| NSIC certificate | Provides MSME benefits and exemptions in tenders | Not renewing on time |

| PAN and bank details | For payment processing | Missing consistency between bid and invoice |

Why readiness reduces risk

For MSMEs, preparing these documents in advance shortens the time to qualify for tenders. It also builds credibility with large buyers and avoids disputes during billing. A practical approach is to maintain a central compliance folder and update it every quarter.

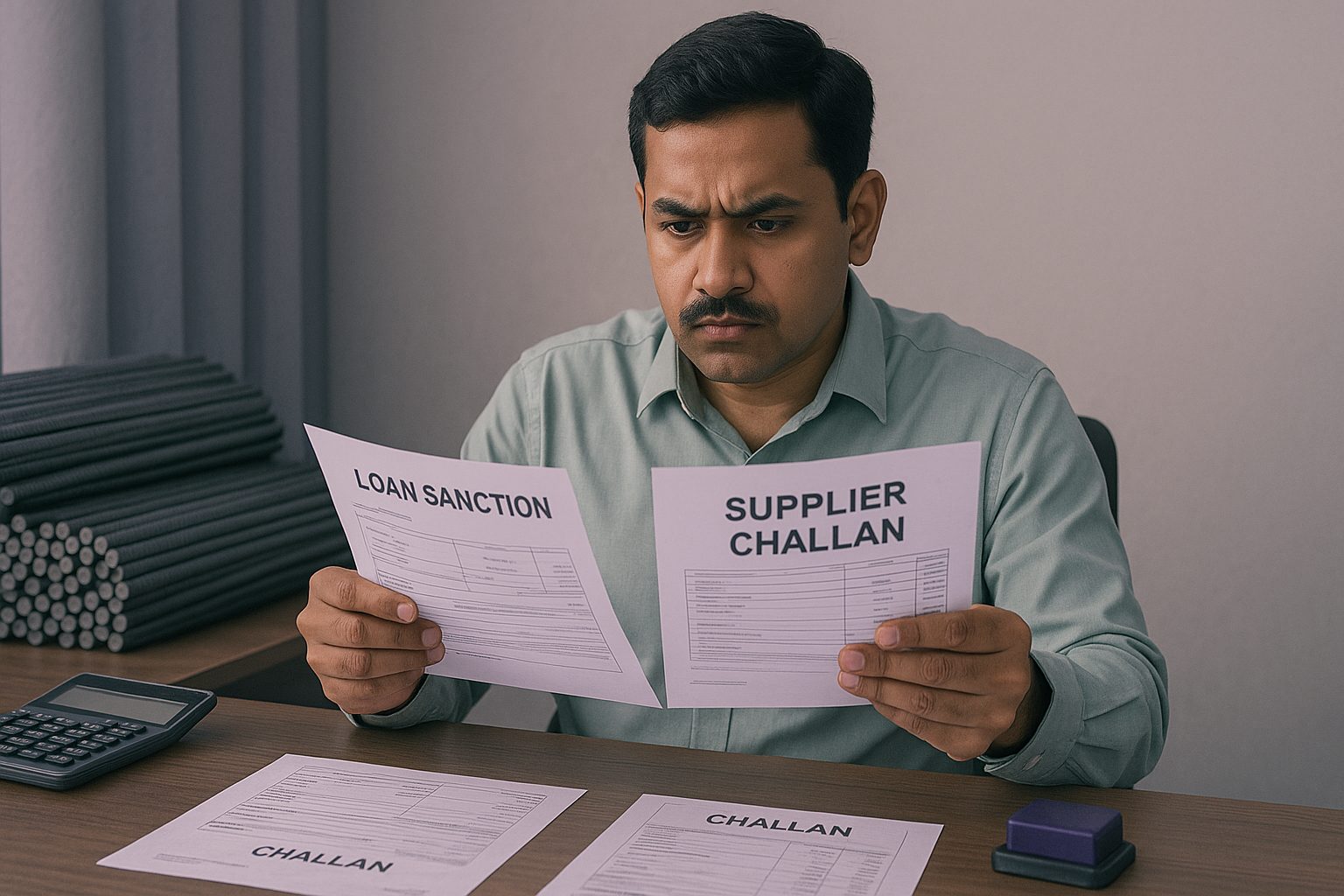

Price protection and financing for MSMEs

Steel prices are unpredictable. They rise and fall with market demand, raw material costs, and even global events. For a small firm working on a fixed-rate contract, this fluctuation is risky. A price set at the start of the project may not hold when deliveries begin.

Larger contractors usually guard against this with a price-variation clause. This clause allows rates to be adjusted if steel crosses a defined benchmark. It is a simple safeguard, yet many MSMEs still sign contracts without it. The result is clear: the supplier passes on the risk, while the smaller buyer absorbs the loss.

How MSMEs fund their purchases

Most firms begin with dealer credit. It is quick, built on trust, and requires little paperwork. But the repayment cycle is short, often within 15–30 days. For a contractor waiting on delayed client payments, this can create serious stress.

Structured loans from banks or NBFCs are safer for large orders. They give longer repayment windows and predictable schedules, though approval takes time. Government contracts under GeM have fixed payment timelines. If planned well, this helps MSMEs manage cash flow more confidently.

Another option is invoice discounting. Here, pending client bills are converted into immediate cash. It reduces the margin, but it prevents project delays when liquidity is tight.

Comparing financing routes

| Option | Key Advantage | Limitation / Risk | Best Use Case |

| Supplier Credit | Immediate access to material, flexible terms | Short repayment cycles, interest risk | Small repeat orders with trusted dealers |

| MSME Loan (Bank/NBFC) | Larger credit limit, structured repayment | Longer approval time, documentation | Bulk orders for projects |

| GeM Payment Terms | Faster settlement via government contracts | Limited to GeM-linked projects | Supplying steel to govt. buyers |

| Invoice Discounting | Quick cash against pending invoices | Discount fee reduces net receivable | When waiting for client payments (delayed client dues) |

Why financial planning matters

Finance does not explicitly mean paying today’s bill. It ensures the project keeps moving tomorrow. A contractor with a credit line in place can absorb sudden price jumps or client delays without losing credibility. In procurement, timely delivery builds reputation. That is worth more than saving a few rupees on interest.

Practical tools for small contractors

For small contractors, steel procurement is not only about tracking today’s rate. It is about linking the requirement at site with the budget agreed in the tender. Many MSMEs lose money here. They check the per-kg price but overlook how it translates into full project cost. However, it must be noted that simple tools can bridge this gap.

From BOQ to budget

Every project begins with a Bill of Quantities (BOQ). It tells how many bars of each size are needed. Converting this into kilograms and then into cost is where errors creep in. Large companies use software for this. Smaller firms can manage with simple calculators or pre-structured excel sheets. Even a basic sheet that converts length and diameter into total weight can prevent costly under-ordering or last-minute top-ups.

Supply risk checklist

Tools alone are not enough. Contractors also need a simple supply checklist: confirm dealer stock before issuing the order, fix transport rates early, and keep one back-up supplier in case of shortage. These practical steps protect against delays that often raise landed costs.

Why this helps

For small contractors, tools and checklists are not extras. They are safeguards. They reduce mistakes in costing, avoid disputes with suppliers, and bring discipline to tender execution. In a market where margins are already thin, that discipline makes the difference between profit and loss.

Conclusion: Making smarter steel procurement decisions for MSMEs

Steel will remain the single largest cost line in most construction-led MSME projects. For buyers, the Agni TMT steel price is only the first figure on paper. What matters more is what happens after – freight added, GST applied, certificates checked, and payments released on time.

Many contractors learn this the hard way. A project that looked profitable at the estimate stage can slip into loss once hidden costs surface or documents fall short at tender evaluation. Others manage better because they prepare: they track landed costs city by city, they insist on variation clauses in contracts, and they line up credit before placing orders.

The lesson is simple. Steel buying cannot be treated as a spot transaction. It needs the same discipline that MSMEs apply to their core operations – planning, compliance, and cash flow management. Firms that build these habits do more than complete projects. They protect their margins, strengthen client confidence, and earn the stability to grow.

Looking to procure steel?

Tata nexarc helps manufacturers, builders and MSMEs source certified steel products, compare prices, and choose the right grade as per IS codes—with complete traceability and procurement confidence.

FAQs

Can MSMEs negotiate Agni TMT prices directly with manufacturers?

Do landed costs vary between project sites within the same state?

How can MSMEs reduce freight costs on Agni TMT orders?

What hidden costs should MSMEs watch out for in steel orders?

How can SMEs track Agni TMT prices regularly?

What is the minimum order quantity (MOQ) for wholesale Agni TMT?

How do MSMEs confirm BIS certification for Agni TMT bars?

Are Agni TMT rates the same across India?

What is the minimum order quantity (MOQ) for wholesale Agni TMT?

How soon can bulk orders of Agni TMT be delivered?

A product manager with a writer's heart, Anirban leverages his 6 years of experience to empower MSMEs in the business and technology sectors. His time at Tata nexarc honed his skills in crafting informative content tailored to MSME needs. Whether wielding words for business or developing innovative products for both Tata Nexarc and MSMEs, his passion for clear communication and a deep understanding of their challenges shine through.

Besides 500D and 500 grades, what other TMT bar grades does Agni offer? Are there any specialized TMT bars for specific applications for buildings?

Agni Steels offers Fe-550D grade TMT bars in addition to 500D and 500. They also offer specialized 60-feet long TMT bars, designed for larger infrastructure projects that require longer spans and fewer joints.

Agni TMTs are really good quality at a decent price which makes them the popular choice in the South India.