Table of Contents

Every month, when the Finance Ministry drops the latest number; this time the July 2025 GST collection; it’s like checking the nation’s pulse. A healthy haul hints that factories are busy, trucks are moving, and shoppers are still tapping “Buy Now.” A softer reading, on the other hand, can warn that demand is cooling or that supply chains are catching a cold.

The figure has just landed, giving businesses one more clue about where the economy is headed as we roll toward the festive season. In the pages ahead, we’ll unpack the headline total, see how much came from each GST bucket, and ask what the refund spike means for cash flow. Stick around—this quick tour could help you plan inventory, pricing, and working capital for the rest of 2025.

What’s Behind the ₹1.95 Lakh Crore Collection?

July’s GST numbers held strong at ₹1,95,735 crore—a clear sign that business activity is steady across sectors. While it didn’t top the charts, the collection was still 7.5% higher than July last year, and marked the fourth month in a row with revenue above ₹1.8 lakh crore. That kind of stability matters. It shows that trade, services, and consumer demand are all moving in the right direction.

Here’s how the numbers break down:

- CGST: ₹35,470 crore

- SGST: ₹44,059 crore

- IGST: ₹1,03,536 crore (₹40,262 crore from imports)

- Cess: ₹12,670 crore (₹1,036 crore from imports)

Most of this came from domestic sales, but imports also pulled their weight. Compared to last July, revenue from imports grew by 9.7%, while collections from within India went up by 6.7%.

Between April and July this year, the total GST collected has reached ₹8.18 lakh crore, showing a 10.7% increase from the same time last year. That’s a strong signal—buyers are spending, businesses are active, and the tax base is widening. With steady numbers like these, many businesses may find it’s the right moment to restock, replan, and stay ready for the coming festive rush.

Who Pulled the Weight in July?

Big collections often tell a simple story: strong consumer demand pulls goods off shelves, factories run hot, and taxes roll in. The July 2025 GST collection sheet is no different. Western and southern hubs still write the biggest cheques, but a few smaller pockets are sprinting ahead on growth.

Top‐Grossing States (July 2025)

| Rank | State | GST collected (₹ crore) |

| 1 | Maharashtra | 30,590 |

| 2 | Karnataka | 13,967 |

| 3 | Gujarat | 11,358 |

| 4 | Tamil Nadu | 11,296 |

| 5 | Uttar Pradesh | 9,760 |

Fastest Movers

- Punjab: up 12 % year-on-year to ₹2,323 crore, thanks to strong agri-processing and light-engineering sales.

- Andhra Pradesh: up 14 % to ₹3,803 crore, lifted by port-led exports of seafood and auto parts.

- Bihar: up 16 % to ₹1,813 crore as FMCG distribution widens in semi-urban belts.

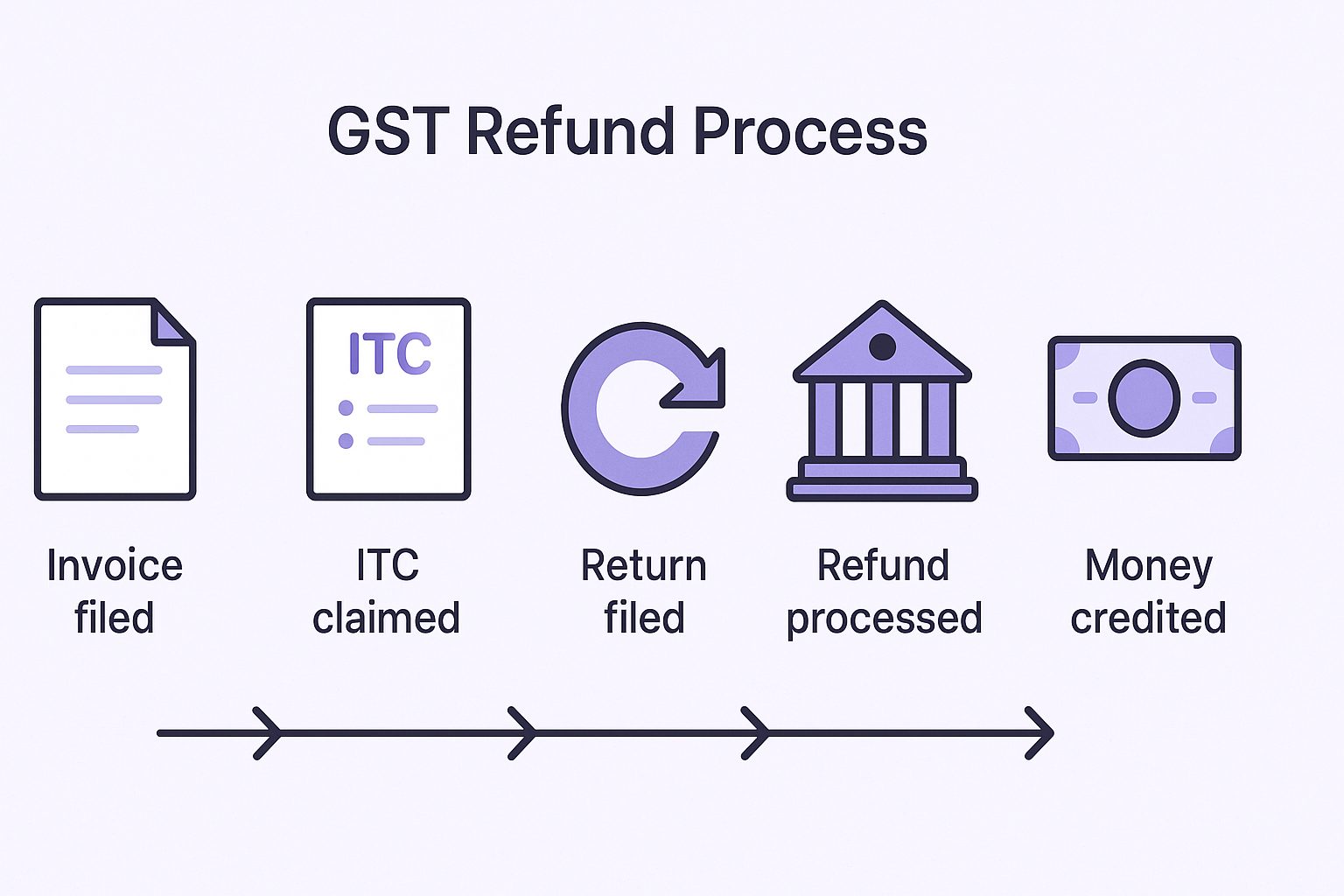

Refund Wave Keeps Cash Moving

The Centre cleared ₹27,147 crore in GST refunds during July—66.8 % more than a year ago. Faster processing eases the strain on exporters locked into inverted duty structures and frees up working capital just when businesses are stocking up for Diwali.

Takeaway: The weight of revenue still sits with the big manufacturing states, but double-digit growth in mid-tier regions shows demand is spreading. Keep an eye on these rising states; they can open fresh supply-chain and sales opportunities long before the headline numbers catch up.

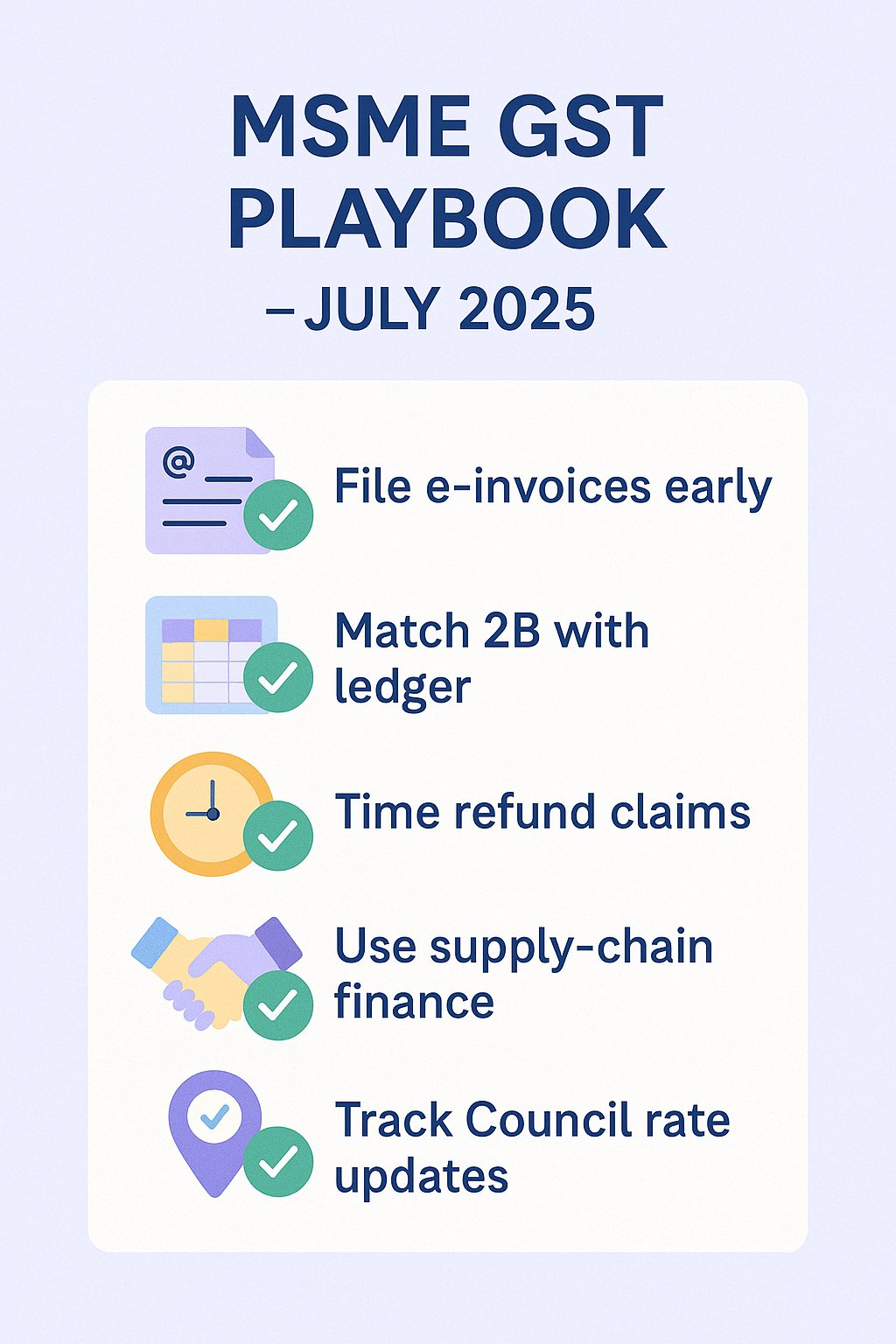

Smarter Compliance, Smoother Cash — A Field Guide for MSMEs

India’s tax grid keeps tightening, but that isn’t bad news if you learn to ride the rails. Below is a plain-spoken checklist you can use right away, whether you run a casting shop in Rajkot or a cloud-kitchen chain in Pune.

Let the Machines Do the Watching

- E-invoicing is now a must for firms over ₹10 crore in turnover. Good software can raise invoices, push data to the portal, and flag mismatches before the taxman does.

- Risk-score dashboards from GSTN have started grading taxpayers. A clean score cuts audit odds and speeds up refunds. Sync your accounts module with the portal every week; don’t leave it for month-end crunch time.

- AI-based reconciliation tools (most are cloud subscriptions under ₹1,000 a month) match purchase orders, e-way bills, and bank feeds in the background. The moment a supplier files late, you’ll see the ITC shortfall the same day—no more surprises at filing time.

Trim the Working-Capital Wait

- Track the “refund clock.” July saw ₹27,147 crore paid back to businesses, a 67 percent leap year on year. Faster back-end processing means money can hit your account in 15–20 days if papers are clean—so file claims the moment outward supplies go live.

- Pair refunds with inventory cycles. Suppose your average stock turns every 40 days. Aim to lodge the refund claim by Day 25; when the credit lands, it funds the next raw-material order instead of tapping bank lines.

- Group purchases by GST rate. Inverted-duty pain (higher tax on inputs than on finished goods) is real in textiles, footwear, and farm machinery. When possible, bundle orders so the high-rate inputs ship in one go; that keeps refund paperwork in a single file, which the portal clears faster.

Fortify the Festive-Season War Chest

- Lock in supplier credit now. Collections stay above ₹1.9-lakh-crore when demand is strong; that demand turns red-hot from September onward. Renegotiate payment terms before factories get busy.

- Use dynamic pricing, not blanket discounts. GST data shows which HSN codes are flying off the shelves. Mark down the fast movers only after Diwali stock clears; protect your margin while demand is still peaking.

- Tap supply-chain finance platforms. Many banks will fund up to 80 percent of verified e-invoices at rates 200–300 basis points below unsecured overdrafts. The paperwork often finishes in two clicks because the tax portal already validated the invoice.

Health-Check Your Books—Monthly, Not Yearly

| Quick Audit Item | Why It Matters | Five-Minute Fix |

| GSTR-2B vs. Purchase Ledger | Missing ITC erodes cash | Run automated match; chase delinquent vendors |

| E-Way Bills vs. Sales Register | Stops under-reporting notices | Tie transport data to ERP in real time |

| Top 10 HSN Codes by Revenue | Shows where demand is shifting | Adjust stock and ads toward rising codes |

Keep One Eye on Policy Signals

- Rate rationalisation is back on the GST Council agenda. If slabs compress, certain input credits could shrink—budget for it.

- Digital Services Tax row: If a global compromise lands, SaaS subscriptions may get cheaper, trimming overheads.

- Petroleum inclusion talk is gaining steam. If fuel moves into GST, expect transport contractors to re-quote within weeks; lock long-haul rates today, with an adjustment clause for tax changes.

Bottom line: Compliance tech is no longer a nice-to-have; it’s the cheapest insurance against cash-flow shocks. Nail your reconciliations now, bank those quicker refunds, and you’ll have the powder dry when the Diwali orders start lighting up the ledgers.

Policy Watch and the Road to September

India’s next GST Council sitting is expected after the monsoon session, toward the end of August. Officials say the agenda is packed: unfinished reports on GST tribunals, a final call on the 28 % gaming levy, and—most keenly watched—rate rationalisation.

Fewer Slabs, Fewer Surprises

The Finance Ministry has signalled that it wants to fold today’s five‐rate grid into three tiers—7 %, 15 % and 28 %—while scrapping the 12 % band altogether. Trackers note that items now in the 5 % or 18 % buckets could move, so businesses should cost products both ways while pricing festive stock.

Gaming Tax Heads to the Wire

The Supreme Court has just wrapped another round of hearings on the Gameskraft case, which challenges the 28 % tax on the face value of online bets. A verdict—or a Council tweak—could drop before October, reshaping one of India’s fastest‐growing digital sectors.

External Wildcards

Across the pond, Washington has confirmed a 25 % tariff on Indian goods starting 1 August. New duties may dent export-linked IGST in coming months, especially for textiles and auto components bound for the U.S. market.

Two-Month Outlook

| Upcoming trigger | Why it matters | Quick action |

| Late-Aug GST Council meet | Possible slab change, tribunal rollout | Run “what-if” margin tests at 7 % and 15 % rates |

| Onam & Ganesh Chaturthi sales (Aug–Sep) | Boosts FMCG, jewellery, and auto demand | Build buffer stock; lock logistics rates early |

| SC ruling / Council tweak on gaming tax | Could redraw the tax base for e-gaming firms | Review contracts with platforms; insert tax-change clauses |

| U.S. tariff goes live (1 Aug) | May slow orders from key buyers | Diversify export mix; explore EU, ASEAN lanes |

Bottom line:

In the next 60 days, businesses must juggle a possible GST‐slab shuffle at home and fresh tariff headwinds abroad. Run quick sensitivity checks, keep refund paperwork tight, and stay nimble on prices—a little prep now can save a lot of margin once the festive rush hits.

Conclusion

July’s GST counter rang up close to ₹1.96 lakh crore, and the cash keeps moving. The usual heavyweights—Maharashtra, Karnataka, Gujarat, Tamil Nadu—did their part, but the real buzz came from smaller pockets like Punjab and Andhra Pradesh that are suddenly pulling bigger numbers. Refunds landed faster, e-invoicing cut the red tape, and trucks kept rolling even as import bills rose. The signal is simple: money is changing hands, factories are humming, shoppers aren’t holding back.

Yet the next two months won’t be on cruise control. A tariff cloud hangs over exports, and the GST Council could shuffle rate slabs before the festive lights go up. Treat those events like weather forecasts—prepare, don’t panic. Nail down raw-material prices early, keep some credit headroom, and refresh your spreadsheets the moment new tax rules drop. Do that, and you’ll meet the Diwali rush with stocked shelves, steady margins, and far fewer sleepless nights.

FAQs

What is considered a “good” GST collection number for India?

How often does the GST Council meet?

Does GST revenue directly benefit state governments?

What sectors contribute the most to GST collections?

Are MSMEs major contributors to GST revenue?

How does a GST refund delay impact small businesses?

What is the role of imports in GST revenue?

How is GST compliance tracked digitally?

Through e-invoicing, GSTR filings, input credit matching, e-way bills, and AI-based risk profiling used by GSTN and the Central Board of Indirect Taxes.

Why do some states see a drop in GST revenue?

Can GST collections predict economic growth?

While not a perfect indicator, rising GST collections often align with higher consumption, stronger manufacturing, and improved economic sentiment.

A product manager with a writer's heart, Anirban leverages his 6 years of experience to empower MSMEs in the business and technology sectors. His time at Tata nexarc honed his skills in crafting informative content tailored to MSME needs. Whether wielding words for business or developing innovative products for both Tata Nexarc and MSMEs, his passion for clear communication and a deep understanding of their challenges shine through.