Table of Contents

Steel doesn’t make headlines often, but it holds the backbone of every road, bridge, rail, and building we see around us. In India, that backbone is only getting stronger. As of mid-2025, the country is producing over 151 million tonnes of crude steel each year, with total installed capacity climbing steadily toward 200 million tonnes. These aren’t just big numbers — they reflect steel plants in India that are expanding with intent.

On the ground, that growth shows up in multiple ways. Plants are scaling up. New districts are entering the map. Odisha still leads in raw volume, but regions like Maharashtra’s Gadchiroli and Haryana’s Hisar are becoming serious contenders. There’s a push toward more sustainable production too, as companies begin testing hydrogen-based manufacturing and shift toward greener logistics.

This guide lays it all out: where India’s major steel plants are located, which companies are investing heavily, and how the industry is shifting both geographically and technologically. Whether you’re tracking market trends or just curious about where the country’s steel comes from — this is the latest picture.

Top 10 Steel Companies in India (July 2025)

Roughly 85 percent of India’s crude-steel tonnage now comes from just ten producers. These firms anchor long-running plants, fund the bulk of new capacity, and set the pace on cleaner processes. Several are pushing large greenfield projects—JSW in Gadchiroli, Tata in Kalinganagar—while public-sector SAIL works through overdue furnace upgrades. Coastal logistics matter more than ever, driving expansions at Hazira and Paradeep. All eyes are also on first-wave hydrogen trials in Hisar and Jamshedpur. The snapshot below shows where each company stands this year.

| Rank | Company | FY-25 Output (approx.) | Main Works | Key Move in 2025 |

| 1 | Tata Steel | 21.8 Mt | Jamshedpur; Kalinganagar | Line-2 at Kalinganagar nearing 8 Mt cap; pilot hydrogen DRI |

| 2 | JSW Steel | ~21 Mt | Vijayanagar; Dolvi; Salem | 25 Mt greenfield plant cleared for Gadchiroli |

| 3 | SAIL | 19 Mt | Bhilai; Rourkela; Bokaro; Durgapur; Burnpur | Phased furnace rebuilds to cut coke rate and CO₂ |

| 4 | Jindal Steel & Power | ~10 Mt | Angul; Raigarh; Patratu | Coal-gas DRI at Angul; ramp to 12 Mt by year-end |

| 5 | AM/NS India | 9.6 Mt | Hazira; Paradeep | Hazira slab line doubling to 15 Mt, export-oriented |

| 6 | Jindal Stainless | 1.9 Mt | Hisar; Jajpur | First hydrogen-ready stainless furnace lit in April |

| 7 | Vedanta (Steel) | — (project stage) | Jharsuguda; Dhenkanal (planned) | ₹1.28 lakh-crore steel–aluminium cluster approved |

| 8 | Visa Steel | ~1 Mt | Kalinganagar | Leverages local ore; pig iron & ferro-alloy focus |

| 9 | Bhushan Power & Steel | ~3 Mt* | Rengali; Jharsuguda | Assets under JSW revival; full restart slated FY-26 |

| 10 | NMDC Steel | 3 Mt | Nagarnar | First greenfield mill from NMDC; production still ramping |

Major Integrated Steel Plants by Region

India’s drive toward a 300-million-tonne steel capacity hinges on a handful of mineral corridors. The richest iron-ore belts run from Odisha through Jharkhand into central Chhattisgarh; coal moves along the same axis, and ports on the east and west coasts keep slab exports flowing. Integrated plants in these corridors handle the whole cycle—sinter, coke, blast furnace, basic-oxygen steel, and rolling—so their location dictates freight rates, input costs, and, ultimately, market prices.

While Odisha, Jharkhand, and Chhattisgarh remain the heavyweights, newer capacity is cropping up in Maharashtra and Gujarat, both favoured for port access and simplified clearances. Karnataka and Tamil Nadu round out the picture with long-running private mills that feed auto and construction demand in the south. Taken together, these seven regions account for nearly all of India’s crude-steel output—and every major expansion plan filed since 2023.

The next subsections walk through each state or regional cluster, naming the flagship plants, their owners, installed capacity, and any ongoing upgrades.

Odisha – India’s Primary Steel Hub

Odisha sits on the heart of India’s iron-ore seam, so it’s no surprise the state hosts the country’s densest cluster of integrated works. Rail links run ore south from Keonjhar and coal in from Talcher, while Paradeep and Dhamra ports carry slab and pellet exports straight to the Gulf and East Asia. Five large complexes set the pace:

- Tata Steel – Kalinganagar (Jajpur)

Phase-1 is steady at roughly 3 MTPA; a second line, now in hot-run tests, takes the site to 8 MTPA once fully ramped. The mill is Tata’s test bed for low-carbon iron using hydrogen and high-grade pellets. - JSPL – Angul

Runs India’s only commercial coal-gasification DRI route. Present melt capacity hovers around 6 MTPA, headed for 12 MTPA by December. A 3,600 m³ blast furnace—the country’s largest—is already online. - SAIL – Rourkela Steel Plant

Public-sector veteran producing flat products for defence and oil-and-gas pipe. Modernisation over the past decade lifted steelmaking to just under 5 MTPA; residual coke-oven rebuilds continue in phases. - AM/NS India – Paradeep Complex

Port-based slab unit backed by ArcelorMittal and Nippon Steel. Current steel capacity is modest, but the adjoining 12-MTPA pellet plant feeds Hazira and export cargoes. Expansion filings target a 6-MTPA BOF line. - Visa Steel – Kalinganagar

Smaller at ~1 MTPA but efficient in pig iron and high-carbon ferro-chrome, leveraging ore right outside the gate.

Together, these works push Odisha’s integrated capacity above 20 MTPA today, with committed projects set to add another 10 MTPA before 2028.

Eastern Steel Belt – Jharkhand & Chhattisgarh

The old coal–iron spine of eastern India still runs strongest through these two states. Ore rolls south from Barbil, coal rolls north out of Korba, and the mills in between have been melting steel for more than seventy years.

- Tata Steel – Jamshedpur (Jharkhand)

Often called the country’s first fully integrated works. About 10 MTPA of crude steel now, with incremental debottlenecking each shutdown. A small hydrogen–DRI pilot was fired up in January. - SAIL – Bokaro Steel Plant (Jharkhand)

Built for flat products in the petro-pipe era. Nameplate sits near 4.5 MTPA; a blast-furnace rebuild and thicker-gauge CR line are in progress to push yields and reduce coke rate. - SAIL – Bhilai Steel Plant (Chhattisgarh)

Supplies rail and heavy structurals nationwide. A seventh caster and enhanced rail-weld line lift output to roughly 7 MTPA. Residual work on the shaft-furnace gas-cleaning system wraps up this fiscal. - JSPL – Raigarh (Chhattisgarh)

The first Jindal site, now focused on plates and coils for wind-tower and bridge projects. Current steelmaking near 3.6 MTPA, backed by a captive 340 MW power block. - NMDC Steel – Nagarnar (Chhattisgarh)

India’s newest greenfield plant. Three-million-tonne BOF route reached “stable run” in April; hot-strip mill still in performance guarantee tests.

Count them all up and the belt hovers just past 28 MTPA today, with steady upgrades rather than splashy new builds—keeping this corridor the quiet workhorse of Indian steel.

Western Steel Zone – Maharashtra & Gujarat

Western India used to be a back-end market for eastern slab, but port access has flipped the script. Deep berths at Hazira, Mundra, and the Konkan coast let mills pull in coal from Australia and ship finished coil straight to Gulf and Africa—skipping crowded rail corridors altogether.

- JSW Steel – Vijayanagar & Dolvi (Maharashtra)

Vijayanagar’s four blast furnaces already churn out 12 MTPA. Dolvi, a port-side unit north of Mumbai, doubled to 10 MTPA after its second BF tapped metal last year. Both draw power from JSW’s own 1 GW captive grid. - JSW Steel – Gadchiroli Project (Maharashtra)

Approved in March: 25 MTPA greenfield complex deep in iron-ore country. Land is being levelled; first melt due 2029 if schedules hold. - AM/NS India – Hazira (Gujarat)

Sits on a private jetty; easy berth access keeps raw-material costs down. Current crude-steel output is 9.6 MTPA, with groundwork under way for a second BOF line that will lift capacity to 15 MTPA. - Welspun & Essar revival sites (Gujarat coast)

Smaller in tonnage—1–2 MTPA each—but geared to pipe and plate for offshore wind and desalination projects.

Add the numbers and the west now fields roughly 23 MTPA, with Gadchiroli alone set to double that figure once steel starts to flow.

Southern Cluster – Karnataka & Tamil Nadu

The south doesn’t have Odisha-scale ore beds, yet two states keep a tight loop going: sponge iron and pellets truck up from Bellary-Hospet, finished bar and coil roll straight down to ports at Chennai, Mangalore and Krishnapatnam.

- JSW Steel – Vijayanagar (Ballari, Karnataka)

Twelve million tonnes a year, four blast furnaces, and its own 1 GW captive power. Vijayanagar feeds auto, appliance and construction demand across the Deccan. A fifth furnace—3,000 m³—has foundations poured; tap-in target is FY-27. - JSW Steel – Salem Works (Tamil Nadu)

Alloy-steel specialist (tool, bearing and gear grades). Runs a smaller BF-BOF loop, roughly one million tonnes, supplied by local chromite and imported scrap. - SAIL – Salem Stainless Plant

Produces flat stainless sheet for defence and rail coach work. Capacity about 0.5 MTPA; ferritic grades now account for half the order book. - Kalyani Steels – Hospet

Mini-integrated route—DRI, EAF, rolling—at just under a million tonnes. Supplies crankshaft and fastener stock to southern auto clusters.

Add the numbers and Karnataka–Tamil Nadu together deliver roughly 15 MTPA of crude steel, most of it aimed at value-added niches rather than bulk export coil.

Other States – Andhra Pradesh, West Bengal, Haryana, Uttar Pradesh

- Vizag Steel (RINL, A.P.) – India’s only shore-based PSU mill; ~7 MTPA after its third blast furnace, plus a rail wheel-shop.

- Kadapa Greenfield (YSR Steel, A.P.) – 3 MTPA project; land prepped, first heat aimed at 2027.

- SAIL Durgapur (W.B.) – Long-product focus, 2.4 MTPA; new bloom caster speeds output.

- SAIL IISCO Burnpur (W.B.) – Modern 4,160 m³ BF and BOF loop; ~2.5 MTPA.

- Jindal Stainless Hisar (Haryana) – ~1 MTPA stainless melt; hydrogen-ready reheating trials underway.

- UP sponge-iron/EAF pocket – Sub-0.5 MTPA units near Sonbhadra, Mirzapur feed local re-rollers.

Combined, these plants yield roughly 13 MTPA today, with Kadapa set to lift the total once it lights up.

Upcoming Steel Mega-Projects

Big builds are still pouring in. Six projects below—already past the paperwork stage—will lift national capacity by roughly 45 MTPA once they’re up and running.

| Project | Promoter | Capacity | July 2025 Milestone |

| Gadchiroli Works | JSW Steel | 25 MTPA | Site grading, rail spur survey underway |

| Kalinganagar Line-2 | Tata Steel | +5 MTPA | Hot-run tests on new BF & BOF units |

| Angul Phase-II | JSPL | +6 MTPA | Coal-gas DRI modules delivered, BF shell up |

| Nagarnar Step-Up | NMDC Steel | +3 MTPA | Second caster & HSM tender floated |

| Dhenkanal Cluster | Vedanta | 6 MTPA (Phase I) | Land pact signed, utilities corridor mapped |

| Kadapa Greenfield | YSR Steel (AP) | 3 MTPA | Boundary wall finished; BF order pending |

Watch-outs:

- Most builds lean on green-bond funding—rate spikes could slow them.

- Raw-material linkage differs: Gadchiroli and Angul sit on ore, Nagarnar must haul coal 600 km.

- EU carbon tariffs land in 2026, pushing all promoters toward hydrogen-DRI or gasification from day one.

Government Approvals & Industrial Parks – Why They Matter

Clearances, rail links, and tax breaks decide how fast new capacity leaves the drawing board. Since early 2024, state corridors and central policy tweaks have tackled three bottlenecks at once—land, logistics, and low-carbon incentives. The highlights below show where red tape has eased and which parks now give first movers a cost head-start.

- Odisha Corridor – Nine new downstream parks approved along Kalinganagar–Paradeep; combined melt pull ~7 MTPA. Sagarmala-funded Duburi–Dhamra rail spur cuts coil transit by one-third.

- Maharashtra “Green Steel” Zone – JSW’s Gadchiroli plant sits inside a 5,000-acre park with duty waivers, round-the-clock power, and plots for two hydrogen-electrolyser farms. Slurry pipeline from Surjagarh ore block replaces 250 km of truck haul.

- Gujarat Maritime Cluster – Unified slab-export tariff at Hazira, Mundra, Pipavav through 2030; coastal SEZ shelters GST and customs.

- Central Moves – Draft PLI-II scheme offers a 20 kWh hydrogen credit per tonne of low-carbon DRI; final rules due FY-26 Q4. New five-year rail-freight contracts let mills lock in ore and coal rates.

These fixes don’t create tonnage, but they shave start-up time and trim export costs for first movers in low-carbon steel.

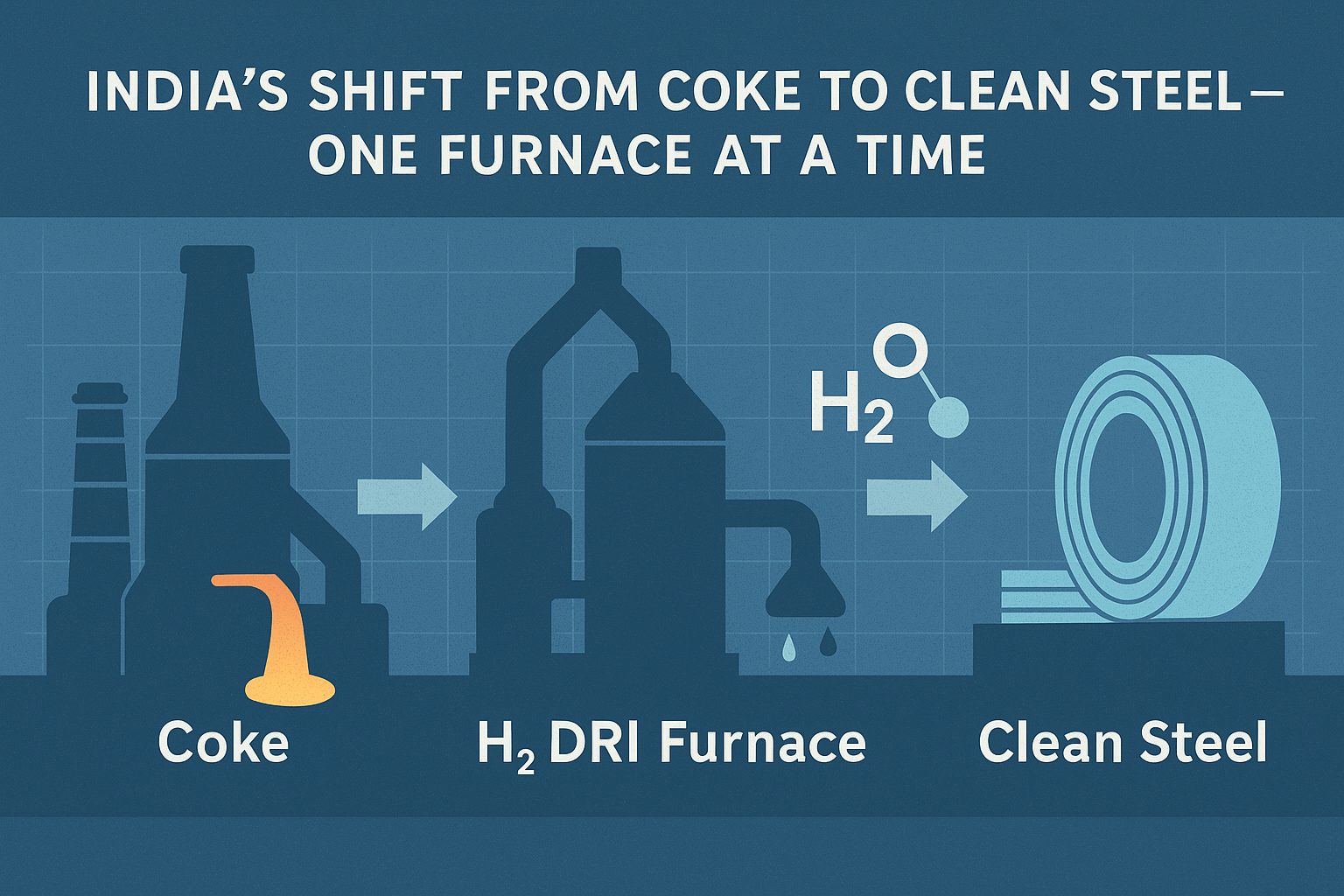

Green Steel & Sustainability Initiatives

Decarbonising India’s blast-furnace fleet is no longer optional. With EU carbon tariffs arriving in 2026 and domestic incentives tied to emissions intensity, major mills have begun real—and uneven—moves toward low-carbon steel.

- Hydrogen trials – Tata Steel injected hydrogen-rich gas into one Kalinganagar furnace in March, trimming coke use by about four percent. Jindal Stainless fired a hydrogen-ready reheat furnace at Hisar; a small H₂-DRI pilot heat is due next year.

- Coal-gas DRI – JSPL’s Angul modules already run on syngas from high-ash coal, avoiding imported natural gas and cutting CO₂ per tonne by roughly one-quarter. Phase II will raise gas share to 70 percent of sponge-iron feed.

- Renewable power & capture – JSW backs Vijayanagar and Dolvi with a one-gigawatt solar-wind mix and is trialling alkaline sorbent capture on a smaller boiler set. SAIL has fitted top-gas turbines at Bhilai and Bokaro, squeezing 30 MW from waste heat.

The policy backdrop helps: the draft Green Steel PLI offers a 20 kWh hydrogen credit per tonne of low-carbon DRI, and new five-year rail-freight contracts reward mills that shift ore on electrified corridors. Progress is patchy, but financing now hinges on a credible carbon-cutting plan—no plan, no money.

Conclusion

India’s steel story is still being written, but the outlines are clear. New capacity—roughly 45 MTPA on the way—will push the country near 250 MTPA by 2030. Eastern ore belts remain the workhorses, yet port-driven mills in the west and greenfield hubs like Gadchiroli are shifting the centre of gravity. The next battle is carbon: hydrogen trials, coal-gas DRI, and renewable power swaps now decide who wins export orders once EU tariffs bite. Scale, location, and emissions discipline—plants that balance all three will set the price of every girder and coil in the decade ahead.

Looking to procure steel?

Tata nexarc helps manufacturers, builders and MSMEs source certified steel products, compare prices, and choose the right grade as per IS codes—with complete traceability and procurement confidence.

FAQs

What are the major raw materials used in Indian steel plants?

Which Indian steel plant is the largest by capacity?

Are Indian steel plants adopting green technologies?

What challenges do steel plants in India face?

How many people are employed by India’s steel industry?

Where are most greenfield steel projects located in India?

What incentives are available for steel plant developers in India?

Which ports support steel exports in India?

What is the role of PSUs like SAIL and RINL in India’s steel future?

How is steel demand forecasted to grow in India by 2030?

Swati is a passionate content writer with more than 10 years of experience crafting content for the business and manufacturing sectors, and helping MSMEs (Micro, Small and Medium Enterprises) navigate complexities in steel procurement, and business services. Her clear and informative writing empowers MSMEs to make informed decisions and thrive in the competitive landscape.

I’m going to start a small fabrication business that uses steel. The list shows plants all over India. Is there a way to find out specifically which plants are closest to my city which is Jaipur, as that might help for my sourcing costs?

Sourcing is only possible through suppliers because they are authorized vendor for manufacturers. We have a big network of suppliers across India. Raise your request on Tata nexarc and get best prices for your steel needs.

We are having a Start up for MSME “ Mizoram Steel Industry” registered under UDYAM we want to have an expert partner outside the state can you recommend any one of those.

please call on 9108240710

Wanted fabricators & equipment manufactors our projects

Thanks for the informative article. Being a construction business owner in Karnataka, it is good to know the location of steel plants in all neighbouring states.

The article focuses on where steel is made, but what processes happen inside the plants? A simple explanation of iron ore to finished steel would be informative, no?

Mecon is not a Steel Plant. They are only consultant.

Essar Steel not in Chhattisgarh but at Hazira in Gujrat.

Thanks Mr. Krishendu!

This is really good to have feedback from our viewers. We will certainly review these and make changes accordingly. Please keep us suggesting for making it a better platform for others.

We hava 45000 MT scrap in Rungabad near. Mumbai if any end consumer of steel plant required please inform me. Thanks. SAIFCO

Give me ur no sir…

We supply dolomite or limestone lumps and powder, any requirements please contact me 87XXXXXXXX Katni (MP)