Table of Contents

- Global steel production overview

- Top 10 steel-producing countries

- Regional insights: What the October data signals

- Global steel demand & price scenarios for 2026

- India in focus

- How India’s growth is reshaping global steel dynamics

- Impact on Indian buyers, traders, & end-use industries

- 2026 outlook: Will India continue to diverge positively?

- Conclusion

In October 2025, the World Steel Association reported that global crude steel production across 70 countries reached 143.3 million tonnes (Mt), a decline of 5.9% year-on-year. This drop in the steel market was driven mainly by a downturn in Asia (particularly China), while parts of the Middle East, Africa and North America showed positive growth.

In contrast, India produced 13.6 Mt of crude steel in October, up 5.9% on the same month last year. For the January–October period, India’s output rose by 10.0%, making it the only major economy simultaneously expanding production and implicitly, capacity at scale.

In this article, we will examine these October figures, look at the regional breakdowns, and reflect on what this means for India’s steel economy, trade position and longer-term strategic role.

Global steel production overview: A market under strain

Global steel production fell 5.9% year-on-year in October 2025, signalling a market under pressure. For January–October, output reached 1,517.6 Mt, a 2.1% decline compared with the same period in 2024.

The slowdown reflects weak construction activity, soft manufacturing demand, and continued policy-driven production controls in key regions.

Key factors behind the October contraction include:

- Sharp output cuts in China

- Lower production across Asia and Oceania

- Industrial stagnation in Europe

- Geopolitical and logistical pressures in CIS countries

- Slowing demand in South America

China’s steep cutbacks

China remains the single largest influence on global steel supply. Its October numbers show a significant retreat:

- 72.0 Mt in October 2025, down 12.1% YoY

- 817.9 Mt from January–October, down 3.9%

This marks one of the sharpest monthly declines in recent years.

Reasons behind the reduction include:

- Weakness in the property and construction sectors

- Emission-control policies limiting output

- Inventory correction across mills and traders

- Cooler export demand from Asia and Europe

Because China produces more than half of the world’s steel, its slowdown directly shifts global availability, price direction, and trade flows.

Asia and Oceania declines

Asia and Oceania together produced 102.4 Mt in October, recording an 8.2% YoY decline.

Major contributors to the fall include:

- Japan: Down 1.0%, reflecting weak auto and machinery demand.

- South Korea: Down 5.8%, due to slower electronics and flat steel orders.

The drop highlights a broader manufacturing slowdown across the region.

Mixed performance across other regions

Global performance beyond Asia was uneven, with several regions still struggling while others improved.

Declines:

- EU (27): Down 3.5%, driven by industrial stagnation and weak consumer confidence.

- Russia + CIS + Ukraine: Down 5.1%, partly due to logistical constraints and subdued domestic consumption.

- South America: Down 1.1%, reflecting weaker steel use in construction and appliances.

Growth pockets:

- Middle East: Up 9.2%, supported by megaprojects in Saudi Arabia, UAE, and Qatar.

- Africa: Up 0.8%, led by recovery in Egypt and North African construction markets.

- North America: Up 4.7%, driven by strong US manufacturing orders and infrastructure spending.

The outcome is an uneven global landscape: developed economies remain soft, China is slowing sharply, but emerging regions continue to show resilience and investment-led growth.

Top 10 crude steel producers in October 2025

The top 10 producers for October 2025 show clear shifts in global competitiveness and regional strength. India stands out as the only major economy delivering strong, sustained growth. Meanwhile, the US, Iran and Türkiye show notable resilience, even as several traditional producers contract.

| Country | Oct 2025 Output | YoY Change |

| China | 72.0 Mt | -12.1% |

| India | 13.6 Mt | +5.9% |

| USA | 7.0 Mt | +9.4% |

| Japan | 6.9 Mt | -1.0% |

| Russia | 5.3 Mt | -6.2% |

| South Korea | 5.1 Mt | -5.8% |

| Türkiye | 3.2 Mt | +3.1% |

| Germany | 3.1 Mt | -3.0% |

| Brazil | 3.0 Mt | -2.7% |

| Iran | 3.3 Mt | +12.0% |

Three major trends define this list:

India is the only consistent high-growth large producer

India achieved 10% growth in the January–October period, far ahead of any other major producer. Its October performance reinforces its position as the fastest-growing major steelmaker. This growth is supported by:

- Strong domestic demand

- Ongoing capacity expansion

- Policy stability and infrastructure investment

The US outperforms other developed economies

The US recorded a robust 9.4% YoY rise in October. Key drivers include:

- Higher steel demand from infrastructure projects under the IIJA

- Reshoring and new investments in manufacturing

- Steady automotive and energy-sector consumption

The US now stands as the strongest performer among advanced economies.

Iran and Türkiye show regional strength

Iran and Türkiye posted 12.0% and 3.1% growth, respectively. Both countries are increasing their footprint in export markets, especially across Asia, Africa, and Middle Eastern construction hubs. Their rising output indicates growing regional influence, particularly in long products and construction-grade steel.

Regional insights: What the October data signals

Asia’s contraction has global price implications

Asia produced 102.4 Mt of crude steel in October, an 8.2% decline from last year. Since the region accounts for nearly 75% of global output, its slowdown has immediate effects on global markets:

- Steel prices may stabilise or rise as China cuts production

- Iron ore demand may weaken, softening seaborne ore prices

- Asian mills may reduce exports to manage stock levels

Asia’s contraction remains the single biggest driver of global steel supply tightness.

Europe’s decline reflects structural weakness

EU crude steel output fell 3.5% to 10.8 Mt, highlighting deeper, long-term industry pressures such as:

- Persistently high energy costs

- Reduced competitiveness against Asian producers

- Slow recovery in manufacturing, especially autos

- Additional cost burdens from strict environmental rules

Europe’s steel sector may face further consolidation, restructuring, or selective shutdowns if current trends persist.

Middle East growth indicates heavy project pipelines

The Middle East recorded 9.2% growth in October, reflecting a region in the middle of major construction and industrial expansion:

- Large project ecosystems such as NEOM, new Dubai real estate, and Qatar infrastructure programmes.

- Expanding local steelmaking in Iran, Saudi Arabia, and the UAE.

- A growing shift from import dependence to regional manufacturing capability.

This growth signals strong long-term demand supported by multibillion-dollar project pipelines.

North America holds steady momentum

North America grew 4.7% in October, supported by:

- A steady economic environment

- High levels of public infrastructure spending

- Reshoring-led growth in the US–Mexico manufacturing corridor

The region remains one of the most stable contributors to global steel demand in 2025.

Global steel demand & price scenarios for 2026

| Scenario | Probability | Key conditions | Likely outcomes |

| Tightened global supply | High | China maintains strict production discipline | • Global supply contracts • Prices for long and flat products rise • Export availability falls • Non-China mills (incl. India) gain competitiveness |

| Moderate recovery | Medium | China raises output early in 2026 | • Prices stabilise • Higher export volumes • Asian mills regain market share |

| Extended downturn | Low | Manufacturing weakens (autos, appliances, construction) | • Demand stagnates even if supply improves • Prices soften or remain flat |

India in focus: Why India stands out in the global economy

India is the only major steel economy showing strong, broad-based growth in 2025. Rising demand, rapid capacity expansion and stable policies make India the standout performer globally.

Domestic demand is expanding faster than global demand

India’s steel demand is growing much faster than the global average. Infrastructure remains the biggest driver, supported by roads, railways, metro projects, ports and major bridges. Real estate demand is also rising, particularly in affordable housing and Tier-2 and Tier-3 cities. Automotives, including EV manufacturing, continue to add volume, while industrial expansion, from cement plants to data centres and renewable energy, keeps consumption strong. Overall demand for FY26 is expected to rise 8–10%, compared with a global average of 1–2%.

Capacity expansion is at a multi-decade high

India is in the middle of one of its largest-ever capacity expansion cycles. Major steelmakers such as JSW Steel, Tata Steel (Kalinganagar Phase II), AM/NS India (Hazira), SAIL, RINL, NINL and Jindal Steel & Power are all adding new units or expanding existing plants. These projects will add 20–25 Mt of additional capacity between 2024 and 2027, the highest growth rate of any major steel-producing nation.

China’s weakness is strengthening India’s export competitiveness

China’s output cuts and focus on balancing domestic supply are creating more space for Indian exports. Indian mills are gaining a stronger footing in South-East Asian and Middle Eastern markets. Hot-rolled coil (HRC) is becoming more competitive, and long-product exporters, such as TMT and wire rod manufacturers, are securing better margins and higher order volumes.

Government policy is strongly supportive

India’s policy environment is giving steelmakers long-term clarity and confidence. The National Steel Policy 2017 targets 300 Mt of capacity by 2030. PLI schemes are supporting downstream steel applications, while the scrappage policy strengthens supply for electric arc furnaces. Import monitoring and anti-dumping rules continue to protect domestic producers, making India’s policy framework more stable than China’s and more expansion-driven than Europe’s.

How India’s growth is reshaping global steel dynamics

India’s strong demand and rapid capacity expansion are now influencing global trade, pricing, and supply partnerships. Below is a simplified breakdown of how India is shifting the global landscape.

India emerges as the new growth engine

With China’s consumption flattening, global miners, equipment makers, and trading houses are increasingly redirecting long-term focus and supply pipelines toward India.

India starts influencing steel price trends

As India’s exports rise and domestic demand remains firm, Indian steel prices gradually play a bigger role in shaping Asian benchmarks, while India’s raw-material buying patterns also impact global coal and iron ore shipping flows.

India builds stronger strategic partnerships

India is deepening collaborations with Australia (iron ore and coking coal), the Middle East (DRI/HBI and energy partnerships), and Japan–Korea (technology and automotive-grade steel capability).

India’s downstream sector expands rapidly

Competitive growth in cold-rolled, structural, stainless, and electrical steel segments is positioning India as a rising global player in high-value downstream steel products.

Impact on Indian buyers, traders & end-use industries

| Segment | Key impact | What it means |

| Steel buyers | Stable-to-firm pricing in Q1 2026 | Prices unlikely to drop sharply; mild upward bias |

| Import cost pressures | Higher landed costs due to global tightness | |

| Better domestic availability | New capacities improve supply options | |

| Traders | Improved export opportunities | Reduced Asian supply boosts Indian export competitiveness |

| Strong demand from nearby markets | Bangladesh, Nepal, Sri Lanka continue sourcing more from India | |

| Wider reach into global markets | Middle East and Africa show increased buying interest | |

| End-use industries | Predictable pricing for autos & appliances | Better planning for OEMs as flat-steel prices stay stable |

| Steady-to-rising long-steel prices | Construction and infrastructure costs may firm up |

Risks and downside factors for India

- Coking coal price volatility may raise production costs

- Port and rail logistics constraints could slow deliveries

- Import surges possible if global steel prices fall sharply

- Domestic demand vulnerable to real estate and construction cycles

Despite these risks, India’s structural growth momentum remains strong.

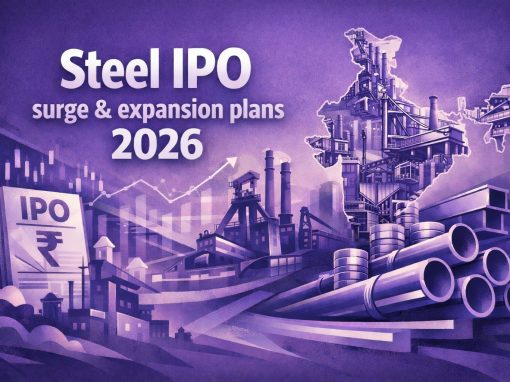

2026 outlook: Will India continue to diverge positively?

India is set to maintain strong momentum in 2026, clearly outperforming most major steel economies. With robust demand, aggressive capacity expansion, and rising export competitiveness, India’s growth path is expected to remain structurally strong rather than cyclical.

India’s 2026 outlook

- Output likely to exceed 155–160 Mt

- Fastest-growing steel demand market globally

- Rapid capacity additions across major producers

- Lower reliance on imports

- Higher finished-steel export potential

Global context

- China expected to maintain moderated production

- Middle East to continue expanding

- Europe to stabilise gradually

- North America to stay steady

Overall, India’s rise is structural, and will increasingly shape the direction of the global steel industry through the next decade.

Conclusion

The October 2025 steel production data shows a global industry undergoing major realignment. With China tightening output and demand recovering unevenly, India stands out as the strongest growth engine. Its 5.9% monthly rise and 10% YTD surge underscore a structural shift driven by expanding capacity, rising domestic consumption, and stable policy support. Despite short-term price and demand volatility, India’s upward trajectory remains firmly intact. The country is no longer just part of the global steel landscape, it is rapidly becoming its new centre of gravity.

Looking to procure steel?

Tata nexarc helps manufacturers, builders and MSMEs source certified steel products, compare prices, and choose the right grade as per IS codes—with complete traceability and procurement confidence.

FAQs

Why did global crude steel production fall in October 2025?

How much did global steel output decline?

Why is China’s production drop so significant?

Which regions showed growth despite the global slowdown?

Why is India considered the strongest performer in 2025?

What is driving India’s rising steel demand?

How is India benefiting from China’s slowdown?

What are the risks for India’s steel sector in 2026?

What is the expected outlook for India in 2026?

How is India reshaping global steel dynamics?

A product manager with a writer's heart, Anirban leverages his 6 years of experience to empower MSMEs in the business and technology sectors. His time at Tata nexarc honed his skills in crafting informative content tailored to MSME needs. Whether wielding words for business or developing innovative products for both Tata Nexarc and MSMEs, his passion for clear communication and a deep understanding of their challenges shine through.