Table of Contents

- Introduction

- What is open market credit? Why MSMEs use it

- Reason 1 – Hidden interest costs are much higher than they appear

- Reason 2 – Unpredictable payment terms hurt cash flow

- Reason 3 – Relationship-based credit leads to supplier dependency

- Reason 4 – No legal protection or structured agreements

- Reason 5 – Informal penalties increase during delays

- Reason 6 – Credit terms change when market volatility increases

- Reason 7 – Limits business growth and credit profile

- Bonus Reason – Hidden costs eat into MSME margins

- What MSMEs should do instead (Smart, low-risk alternatives)

- How to transition away from open market credit

- Impact: How avoiding open market credit strengthens MSMEs

- Conclusion

- FAQs

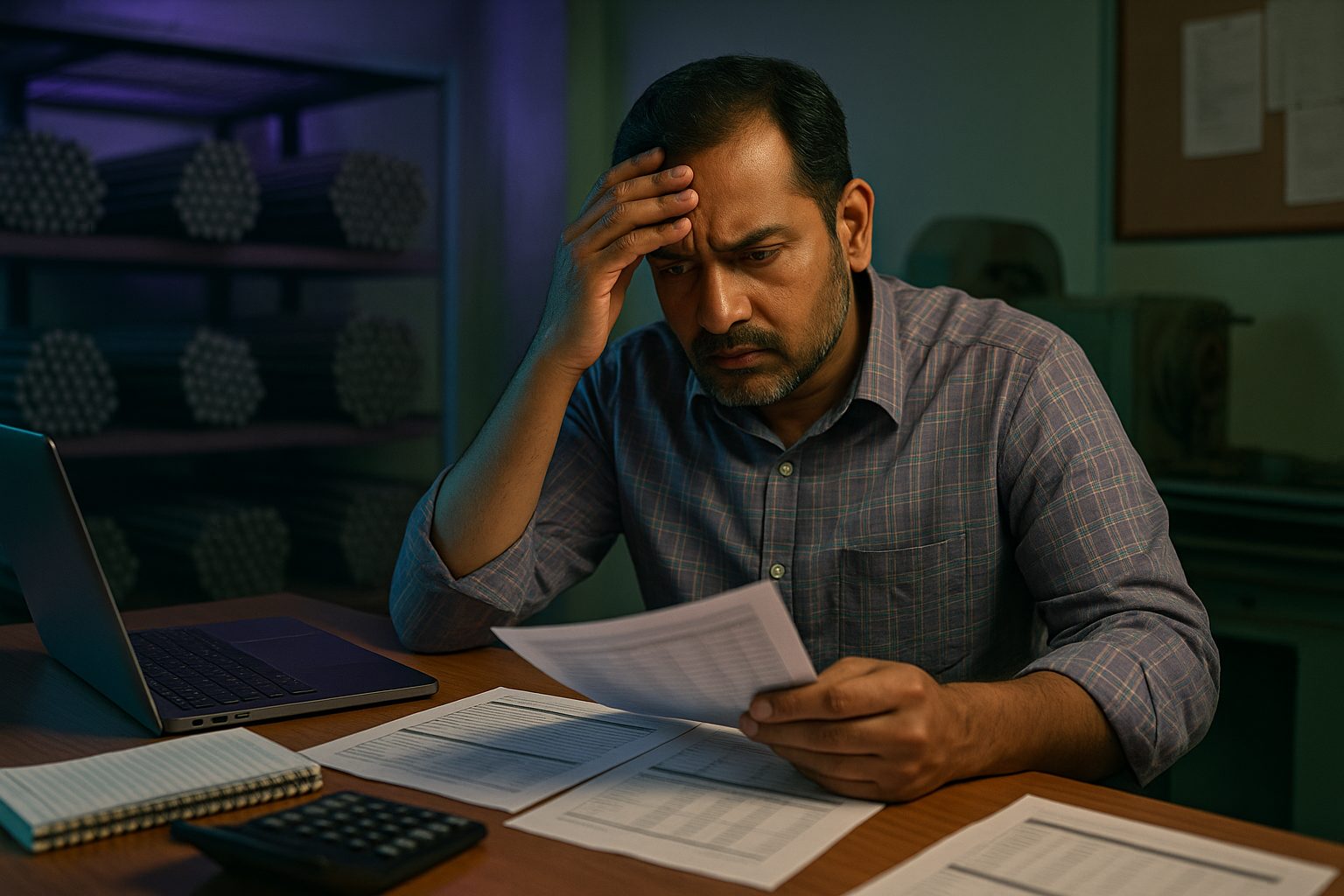

Introduction

For most MSMEs in India, credit is not just a financial tool, rather, it is the backbone of routine operations. And businesses often rely on open market credit (commonly known as, ‘udhaar’) – whether it’s related to purchasing raw material, managing supplier payments, and keeping production steady. Usually, they take udhaar from traders, dealers, local financiers, etc. to stay afloat. It feels flexible, fast, and relationship-driven – everything a time-pressed MSME needs.

But in reality, open market credit comes with hidden costs, unpredictable terms, financial risks, and so on that can quietly weaken a business. In 2025, these risks have grown even sharper. That said,

- Volatile commodity prices,

- Longer payment cycles from customers,

- Shrinking margins,

- Rising working-capital needs, etc.

have created a fragile environment where the wrong credit source can derail production, delay dispatch commitments, and drain profitability.

Most MSMEs does not realise how much money they lose just because their credit source is informal and unregulated. What appears as a favour often turns into dependency, poor negotiation power, and mounting financial pressure.

This guide breaks down why MSMEs must rethink open market credit in 2025 – and what smarter, structured, and low-risk alternatives they can adopt to ensure stability, control, and sustainable growth.

What is open market credit? Why MSMEs use it

Open market credit which is commonly known as udhaar – is one of the most widely used yet least understood credit mechanisms in India’s MSME ecosystem. It refers to informal or semi-formal credit extended by suppliers, dealers, brokers, local financiers, etc. without structured agreements, fixed terms, or documented interest rates.

What open market credit looks like in practice

- A supplier extends 15–45 days of payment flexibility

- A dealer allows you to take material today and pay “when possible”

- A broker gives short-term rolling credit based entirely on relationship

- A local financier gives cash against verbal assurance or personal trust

There is no paperwork, no defined repayment schedule, and no transparent pricing.

The entire system runs on relationships, verbal commitments, and market pressure.

Why MSMEs rely on open market credit

Being all the risks related to open market credit, still MSMEs depend on it for multiple reasons. These include:

Slow and complex bank loan approvals

Formal credit oftentimes requires documentation, collateral, financial statements, and waiting periods that business owners find difficult to meet..

High collateral or guarantee requirements

Many small businesses don’t have assets to pledge. Thus, it pushes them toward informal credit.

Limited awareness of formal credit options

Most of the MSMEs remain unaware of other formal credit options such as digital credit lines, invoice discounting, or structured supply-chain credit.

Supplier-driven pressure

In many industries, suppliers set the terms:

“If you buy from me, you take my credit terms. That’s how we work.”

Perception of convenience

No forms, no KYC, no bank visits – open market credit “feels easier,” even if it’s costly.

While this credit looks flexible on the surface, the financial and operational cost is far higher than most MSMEs realise. And as the market becomes more volatile in 2025, these hidden risks can directly impact profitability and business stability.

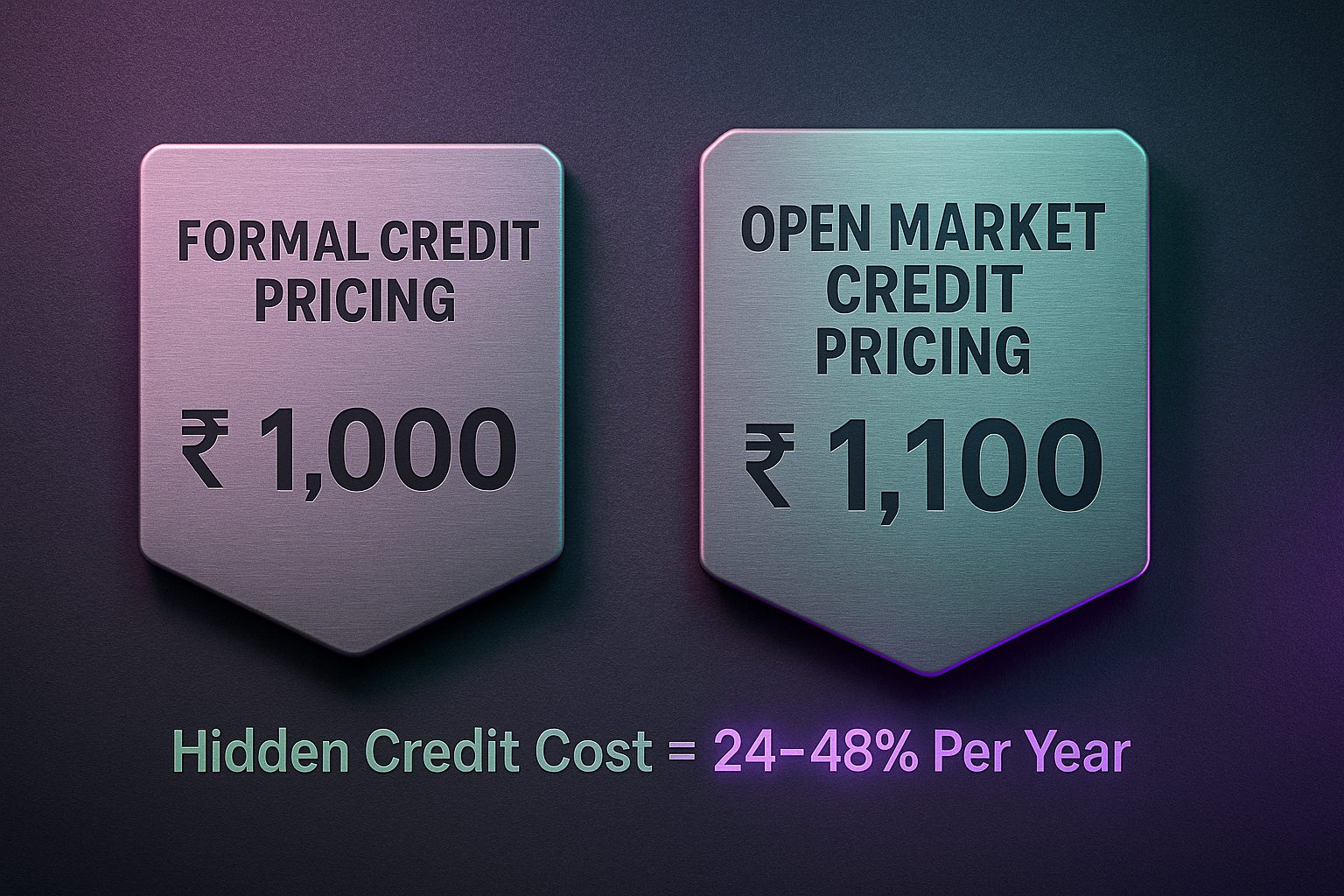

Reason 1 – Hidden interest costs are much higher than they appear

On the surface, open market credit looks “interest-free.”

In reality, MSMEs end up paying some of the highest borrowing costs in the entire credit ecosystem.

Suppliers and dealers rarely charge interest formally. Instead, they quietly adjust pricing:

How hidden interest gets built into pricing

- Higher rate per tonne/kg on material

- No access to market discounts

- Extra charges during high-demand periods

- Lower credit period than promised

- Bundling of slow-moving or lower-quality stock

When these hidden factors are converted into an effective annualised rate, open market credit often costs:

➡ 24% to 48% per year – sometimes even more

Because MSMEs are not shown an interest rate on paper, they don’t realise how much they’re paying. But the supplier always includes the credit risk and delay cost in the price.

Why this is dangerous for MSMEs

- You lose negotiation power

- You never receive true market rates

- Your input cost silently increases

- Profit margins shrink without warning

In tight-margin industries like steel, fabrication, engineering, EPC supplies, auto components, or trading – even a ₹2–₹3/kg premium can severely impact profitability.

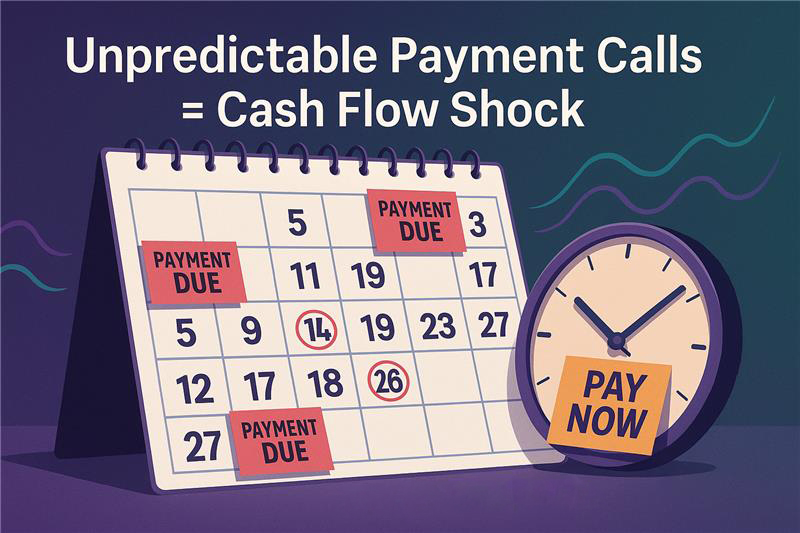

Reason 2 – Unpredictable payment terms hurt cash flow

Open market credit rarely comes with written terms. Everything operates on verbal commitments, personal equations, market conditions, and the supplier’s convenience. This unpredictability is among one of the biggest reasons why businesses face sudden cash-flow shocks.

Now, the question arises is, why payment terms become unpredictable?

- Credit period is never fixed. So, it can shift from 30 days to “pay tomorrow”

- Suppliers demand payment sooner when their cash cycle tightens

- Sudden price fluctuations which lead to abrupt credit withdrawal

- Supplier priorities change based on larger buyers or urgent orders

Impact on MSME cash flow

When payment timelines change unexpectedly, MSMEs often must:

- Pull money from salary or vendor payments

- Pause purchases for the next production cycle

- Delay dispatches due to lack of raw material

- Break planned cash-flow cycles

- Reallocate funds meant for rent, electricity, GST, or EMIs

One unexpected payment call can derail an entire working capital cycle.

Why this is dangerous in 2025

As customer payment delays increases and margins tightens, then it may lead to unpredictable cash outflows. That can:

- Trigger production downtime

- Lead to material shortages

- Cause order delays and penalties

- Hurt tender performance and buyer confidence

Cash flow is the lifeline of an MSME – and open market credit introduces too much uncertainty at the worst time.

Reason 3 – Relationship-based credit leads to supplier dependency

Open market credit is built on relationships and not rules. Initially, it may seem like an advantage, but with time, it quickly creates a dependency trap where the supplier holds more control than the business owner.

How this dependency forms

- Credit is tied to “loyalty,” not business terms

- Supplier in time expects you to buy only from them

- Negotiation slowly becomes one-sided

- Prices remain higher than market rates

- You are not able to switch suppliers without repaying dues first

Over time, MSMEs lose the freedom to even compare prices, explore better quality, diversify sources, negotiate terms, etc.

And hence the hidden commercial impact supplier dependency limits, it involves:

- Ability to switch to better-priced vendors

- Access to competitive market rates

- Choice of product grades and quality

- Opportunity to buy during low-price cycles

- Flexibility to scale production across multiple suppliers

Consequently, many MSMEs get locked into this cycle for years just because they can’t break from an old credit-based relationship.

Why this is risky for MSMEs?

With steel, copper, chemicals, and also commodity markets fluctuating frequently, being tied to only one supplier’s credit terms means you might miss out on:

- Cheaper alternatives

- Faster delivery options

- Volume-based discounts

- Multiple sourcing channels

- Strategic procurement decisions

In a competitive market, supplier dependency directly weakens your commercial agility.

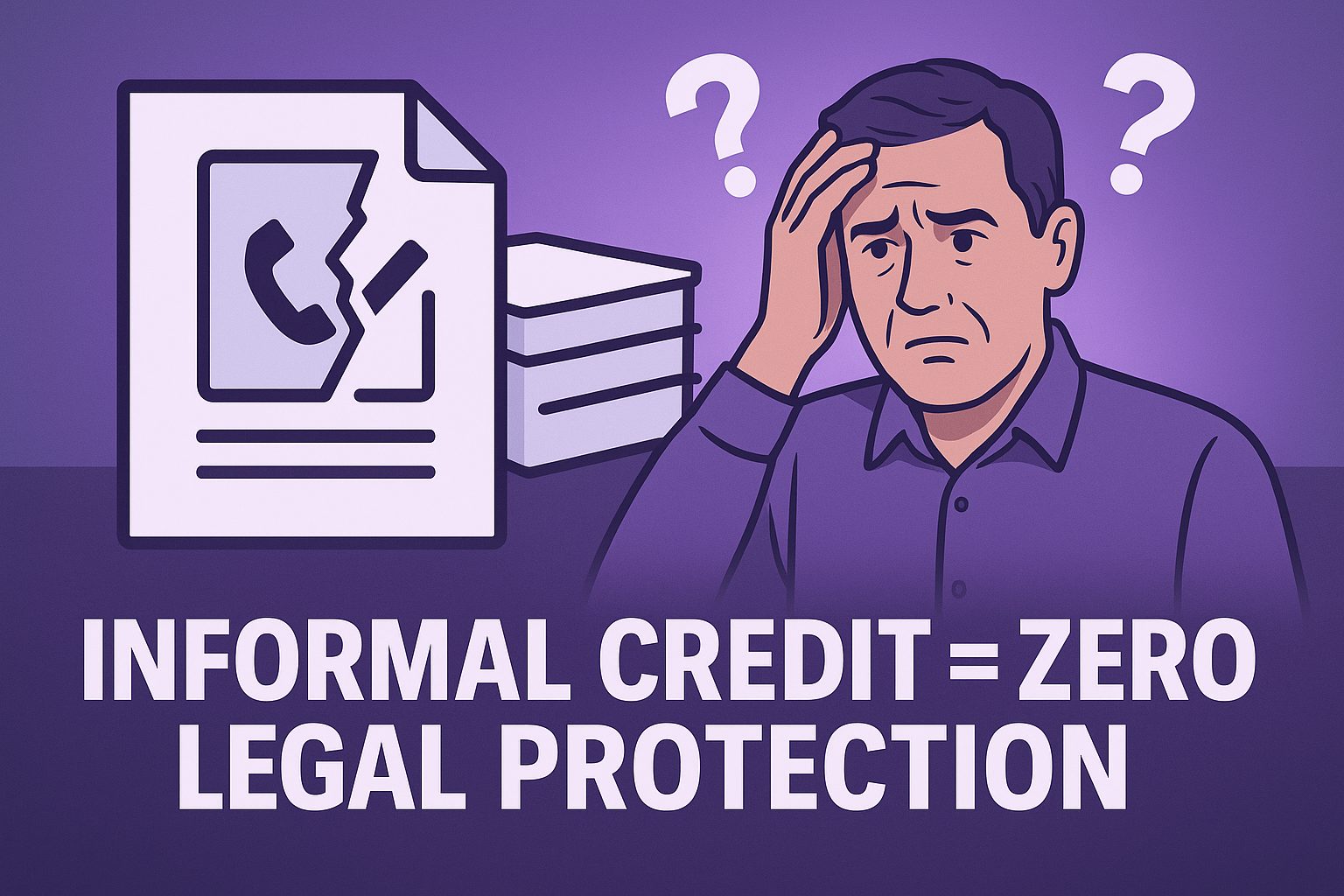

Reason 4 – No legal protection or structured agreements

Most of the time, open market credit runs on verbal commitments, mutual trust, market relationships, and so on. While this may seem convenient, but it leaves MSMEs with zero legal protection if something goes wrong. Thus, there may be consequences later on and makes it risky. Let’s have a look at some of the reasons why it becomes risky:

- No written agreement

- No defined credit period

- No penalty clarity

- No dispute resolution method

- No documentation on interest or charges

That said, the supplier controls everything. The terms, timelines, consequences, etc., and the MSME has no enforceable rights.

Real-world problems MSMEs face

When disputes arise, MSMEs often face:

- Threat of supply suspension

- Pressure to clear dues immediately

- Sudden withdrawal of credit

- Personal-level collection pressure

- Unofficial penalty demands

- Compromised business relationships

Without documentation, MSMEs cannot approach legal channels, banks, or authorities for support – everything becomes a matter of “who says what.”

Why this is a serious risk in 2025

With tighter margins and more disputes over pricing, quality, and delivery timelines:

- Any credit dispute can stop production

- A blocked supply can halt a tender delivery

- Non-payment can lead to market reputation issues

- Disagreements can escalate rapidly without formal structure

In today’s business environment, informal credit = formal risk.

Reason 5 – Informal penalties increase during delays

In open market credit, penalties are never written – but always applied.

And these penalties become harsher when payment delays increase, which is common in today’s slow cashflow environment.

How informal penalties show up

Suppliers may:

- Increase the next order’s pricing

- Cut down the credit period without notice

- Add “adjustments” or rounding charges

- Delay material dispatch until dues are cleared

- Restrict quantity supplied

- Refuse urgent or small-lot requirements

These penalties aren’t documented, but the financial impact is real.

In addition, these penalties increases during delays as:

- Suppliers face their own cash pressure

- Market volatility requires them to be cautious

- They prioritise buyers with on-time payments

- They use penalties as leverage to recover old dues

The biggest issue?

Businesses are not able to challenge the penalty just because nothing is written down. Thus, it may impact on MSMEs with:

- Higher raw material cost

- Delayed production cycles

- Lost customer commitments

- Lower negotiating power

- Strained supplier relationships

Over time, these informal penalties can cost more than formal interest charged by banks or digital credit providers.

Why this risk grows?

With customer delays increasing (especially in EPC, manufacturing, fabrication, trading), even a small slowdown in collection can trigger:

- Immediate supplier pressure

- Sudden demand for full payment

- Blocked credit lines

- Halted material dispatch

Open market credit looks flexible – until you delay once.

Reason 6 – Credit terms change when market volatility increases

In open market credit, nothing is fixed – not the interest, not the duration, not even the amount you can buy. When the market becomes volatile, suppliers change credit terms overnight, leaving MSMEs exposed at the worst possible time.

How market volatility affects supplier credit

When steel, copper, chemicals, or commodity prices rise sharply, suppliers at that time usually:

- Reduce the credit period

- Demand faster/ upfront payment

- Tighten or completely stop credit for smaller MSMEs

- Increase the Minimum Order Quantity

- Prioritise cash-paying customers

- Add hidden premiums to compensate for risk

This, as a result, puts MSMEs in a vulnerable position, essentially, during fast-moving markets.

What MSMEs face in these situations

- Reduced or stopped supply when they need it the most

- Forced to buy at peak prices due to urgency

- Inability to fulfil tenders or dispatch orders

- Payment pressure from both supplier and end-customer

- Cashflow collapse due to sudden changes

Why this becomes critical in 2025

2025 markets are marked by:

- Frequent raw material price swings

- Global import fluctuations

- Uncertain demand in construction, infra, automotive

- Slowdown in receivables across MSME sectors

In such conditions, open market credit becomes unpredictable and unstable – making planning nearly impossible. This may even impact on business operations by breaking production continuity, disrupting procurement schedules, damaging customer commitments, adding unplanned costs and, also increasing stress on owners, finance teams, etc.

Therefore, when credit terms shift without warning, businesses lose control over both procurement and delivery. The two core pillars of business reliability.

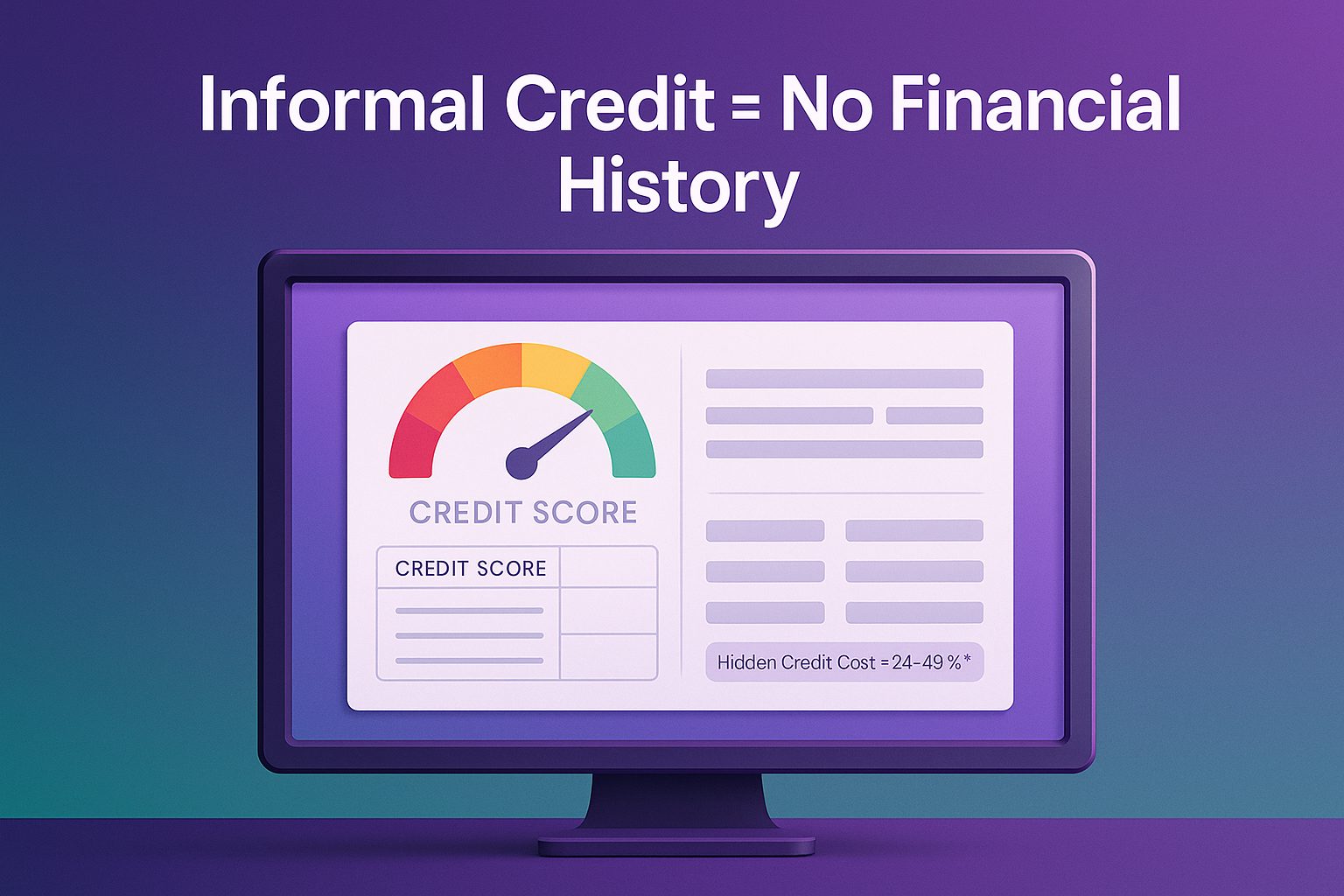

Reason 7 – Limits business growth and credit profile

There’s no wrong, when we say open market credit may provide temporary breathing room. But it does nothing to strengthen an MSME’s long-term financial health. And, in fact, it actively prevents businesses from building a credible credit profile – something that is very essential for growth these days.

Why open market credit doesn’t build your financial history

- No documentation means no track record

- Banks cannot verify your repayment behaviour

- Fintech lenders cannot assess your creditworthiness

- Credit bureaus cannot record your business reliability

So even if an MSME pays suppliers on time for 5–10 years, none of that contributes to a formal credit profile.

How this impacts business growth

Because no formal credit history is created, MSMEs struggle to obtain:

- Working capital term loans

- Overdraft (OD)/ Cash Credit (CC) limits

- Invoice discounting

- Supply-chain financing

- Government schemes & subsidies

- Large credit lines from digital lenders

Without these, MSMEs remain stuck in the same small cycle of purchases and production.

Now, look at the below long-term consequences for MSMEs:

- Business growth remains slow

- Expansion becomes difficult

- Tender participation becomes limited

- Banks classify MSMEs as “high risk”

- Interest rates remain higher even for formal loans

Why this matters?

As industries formalise and supply chains become more compliance-driven, companies increasingly demand vendors with:

- Strong financial discipline

- Documented credit history

- Predictable working-capital systems

MSMEs relying only on open market credit risk being left behind in a more structured, data-driven business environment.

Bonus reason – Hidden costs eat into MSME margins

Apart from the above reasons we discussed above including interest, penalties, payment terms, etc. – open market credit carries a wide range of hidden commercial costs that quietly reduce profitability. These costs are rarely discussed, never documented, and almost impossible to even quantify – yet they affect MSMEs every single month. Let us have a quick look at these:

Higher product pricing

Mostly suppliers cushion their credit risk by increasing the base price of material. And MSMEs end up paying more per kg/tonne than cash buyers and thus, eroding margins.

Forced bundling of low-moving stock

To maintain the credit relationship, businesses are many a times compelled to buy:

- old inventory

- slow-moving goods

- leftover lots

- mixed-quality batches

This increases waste and reduces the efficiency of procurement.

Advance blocking for future orders

Some suppliers ask MSMEs to “keep an advance ready” to ensure:

- faster delivery

- priority supply

- locked pricing

This temporarily freezes working capital that could be used more effectively elsewhere.

Cost of disputes and delays

When disputes arise – about quantity, quality, or pricing – the absence of a written agreement forces MSMEs to absorb:

- delayed dispatches

- partial shipments

- rework cost

- transport inefficiencies

These small leakages accumulate into significant annual losses.

Relationship fallout costs

If credit terms becomes unfavourable, MSMEs often face:

- last-minute payment pressure

- complete supply cut-off

- bad market reputation

- loss of long-term vendor stability

These issues are difficult to recover from and can disrupt operations immediately.

Thus, it can be concluded that open market credit might seem free and flexible, but these hidden margin leakages make it far more expensive than any structured or formal credit option.

What MSMEs should do instead (Smart, low-risk alternatives)

So, to avoiding open market credit does never mean to slow down business operations. Rather, it means choosing structured, transparent, and predictable credit options. That safeguard cash flow and strengthen long-term financial stability.

Here are some of the smarter alternatives every business owner should consider in coming months:

Structured supplier credit (with documentation)

Many organised suppliers offer formal credit terms. However, these are provided only if documented clearly.

Benefits:

- Fixed timelines

- Clear interest or no-interest structure

- Predictable payment cycles

- No hidden costs/ Transparent pricing

- No surprise penalties

Thus, documented supplier credit also helps MSMEs build trust and negotiate better over time.

Trade credit platforms/ Digital credit lines

Modern digital platforms offer pre-approved credit limits for raw materials, steel, consumables, inventory purchase, etc.

Benefits of such credit:

- Quick approval

- Lower interest when compared to open market

- Zero collateral in many cases

- Flexible usage (pay as you use)

- Fully digital KYC & repayment tracking

Hence, this type of credit is perfect for MSMEs that needs recurring, short-term working capital.

Bank working capital OD/ CC limit

Overdraft and Cash Credit lines help MSMEs manage fluctuating working capital needs.

Benefits:

- Lower interest cost

- Can withdraw only what is needed

- Builds strong credit history

- Makes MSMEs eligible for higher limits in future

Also, banks offer MSME-focused schemes with reduced collateral and priority approval.

Invoice Discounting/ Bill Discounting

If customers pay late, then MSMEs can quickly convert unsettled invoices into immediate cash.

Benefits:

- Improves cash flow predictability

- Reduces credit dependence on suppliers

- Shortens the working capital cycle

- Helps MSMEs deliver orders on time

This type of credit is especially useful for those supplying EPC, manufacturing, large corporations, and so on.

Secured or Unsecured MSME digital loans

Fintech lenders, NBFCs, etc. offer MSMEs with instant or short-term loans that require minimal paperwork.

Benefits:

- Fast disbursal

- No collateral in most cases

- Flexible repayment

- Clear interest rate

- Builds financial discipline as well as credit score history

In 2025, digital loans have even become reliable and commonly used by MSMEs of all sizes.

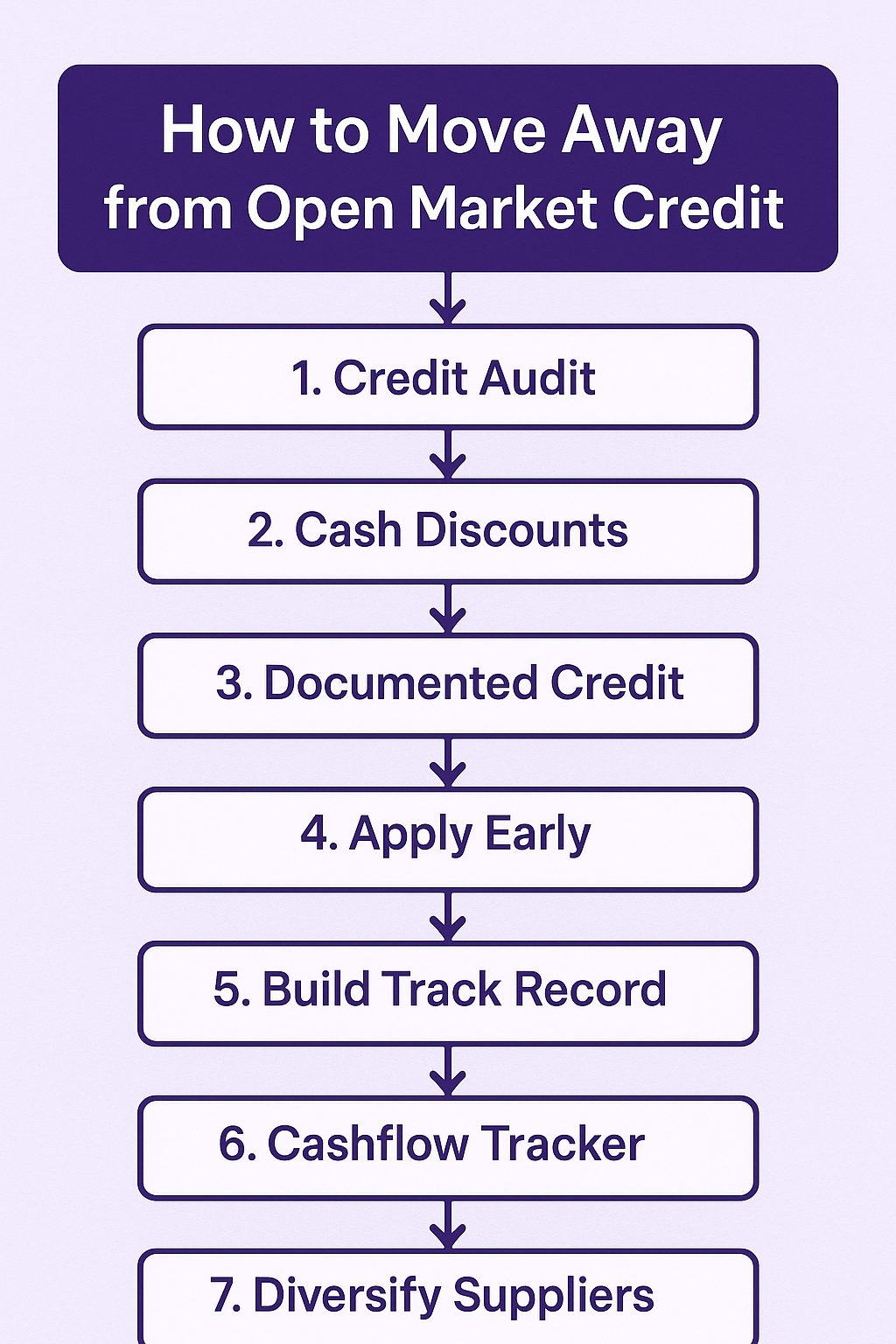

How to transition away from open market credit

Shifting from open market credit to structured or formal credit does not have to be disruptive. Rather MSMEs can transition smoothly with a step-by-step practical approach that protects their cash flow and at the same time strengthens financial discipline.

Step 1: Audit your current credit expenses

Identify hidden premiums, penalties, extra pricing, and dependency risks. As most MSMEs realise they’re paying far more than they thought.

Step 2: Negotiate cash discounts instead of taking supplier credit

Suppliers often offer 2–5% cash discounts when buyers avoid udhaar. And this directly improves margins.

Step 3: Shift part of your procurement to documented credit

You can start small, i.e., move 20–30% of your monthly raw material or stock purchases to formal channels.

Step 4: You can apply for structured credit options early

Banks, NBFCs, or digital credit platforms help approving credit faster when documents are ready. And thus, avoid waiting until cash flow becomes tight.

Step 5: Build a clear repayment track record

Consistent regular repayment also helps build a clean credit history. That is essential for higher limits later, as it even help better CIBIL score.

Step 6: Maintain a simple cash flow tracker

Track:

- Receivables

- Payables

- Inventory cycles

- Loan repayments

- Procurement cycles

Even a basic spreadsheet helps prevent credit stress.

Step 7: Reduce dependency on a single supplier

Gradually diversify sourcing across multiple vendors so your business doesn’t get stuck with one seller’s credit terms or market pressures.

This way you can practically transition away from open market credit. That said, this sift is not just a financial shift, but it’s a strategic business upgrade that increases resilience, control, and growth potential.

Impact: How avoiding open market credit strengthens MSMEs

Now, when MSMEs move away from open market credit and shift to structured, transparent financing, the impact is visible across every part of the business. That said it is not just about reducing risk – it’s about strengthening long-term growth potential. Let’s see how it helps:

Better negotiating power

Without depending on a supplier’s credit, businesses can freely:

- Compare prices

- Choose better-quality material

- Switch to different vendors

- Negotiate based on merit and not obligation

Hence, directly improves procurement efficiency.

Lower procurement cost

With cash payments, transparent credit, etc.:

- Suppliers offer discounts

- Material pricing becomes consistent

- Hidden premiums disappear

- Bulk-buy negotiation becomes possible

With this, businesses can end up saving more per order.

Predictable cash flow

Formal credit provides businesses with:

- Fixed repayment dates

- No sudden payment calls

- Clear interest structure

- Consistent payment cycles

This stabilises working capital and supports production planning.

Professional financial discipline

Moving away from udhaar encourages businesses to maintain:

- Cleaner books

- Stable receivable/ payable cycles

- Documented credit history

- Stronger internal controls

This, hence improves credibility with customers and lenders.

Higher eligibility for loans and credit

When using formal credit, it helps building:

- GST-linked financial history

- Bank transaction patterns

- Clear record of repayments, and, as result,

It helps businesses become eligible for OD/CC facilities, working capital loans, digital credit lines, government/MSME schemes, and larger credit limits.

Improved buyer and supplier confidence

A financially stable business is more reliable for big corporates, EPC companies, auto OEMs, government departments, long-term procurement planners, etc. Thus, it strengthens partnerships and opens new opportunities.

As discussed above, when MSMEs avoid open market credit, that’s not just a defensive move but, it is a competitive advantage. That helps improves margins, cash flow, scalability, and financial resilience.

Conclusion – Convenience should never cost your business

Open market credit feels easy, familiar, and relationship-driven – but in 2025, it carries more financial risk than ever. Hidden costs, unpredictable terms, sudden supply blocks, and the absence of legal protection can quietly erode an MSME’s margins and stability. So, what looks like freedom oftentimes ends up becoming dependency, stress, and long-term loss.

In 2025, as markets become more volatile and customers tighten payments, therefore, MSMEs need predictable, transparent, and structured financing to operate confidently. Consequently, shifting to formal credit options – documented supplier credit, digital credit lines, bank OD/CC, invoice discounting, and MSME loans – gives businesses the control they need over pricing, procurement, and cash flow.

In the long run, MSMEs that choose structured credit over open market udhaar protect their profitability, improve working capital efficiency, and gain stronger bargaining power.

And hence it can be said that the right credit source doesn’t just support your business – it elevates it!

Looking to procure steel?

Tata nexarc helps manufacturers, builders and MSMEs source certified steel products, compare prices, and choose the right grade as per IS codes—with complete traceability and procurement confidence.

FAQs

Does open market credit affect my inventory planning?

Can I claim open market credit as an expense in tax records?

Is open market credit treated as a business liability?

Can open market credit reduce my negotiation power with new suppliers?

Do banks consider open market credit while assessing working capital limits?

Can open market credit make landed costs unpredictable?

Does taking large open market credit improve my business rating or score?

Can open market credit disrupt tender execution?

Can open market credit distort my cash flow forecasting?

Does long-term dependency reduce chances of getting bank overdraft limits?

Charul is a content marketing professional and seasoned content writer who loves writing on various topics with 3 years of experience. At Tata nexarc, it has been 2 years since she is helping business to understand jargon better and deeper to make strategical decisions. While not writing, she loves listing pop music.