Table of Contents

Most businesses in India don’t start with large offices or deep pockets. They start small—maybe with a borrowed desk, a couple of reliable contacts, and more risk than comfort. These are the ventures that keep neighbourhood markets busy, create steady work, and quietly push the economy forward. The MSME full form is Micro, Small, and Medium Enterprises—a simple phrase that describes this massive network of businesses across the country.

In 2025, the government changed how these enterprises are classified. It wasn’t just a tweak in paperwork. The new rules decide who can get financial help, join certain tenders, or tap into schemes that were out of reach before.

For anyone running a business—or thinking of starting one—understanding where you fit in the updated MSME list is essential. It shapes your access to loans, contracts, and other forms of support that can make growth easier.

What follows is a straightforward guide: what the term MSME really means today, what’s different after the latest update, and how you can register without wasting time or money.

MSME Full Form and What It Means Today

MSME means Micro, Small, and Medium Enterprises. That’s the official name. It’s how the government groups businesses by size.

This includes a lot—small shops, local manufacturers, traders, service providers, even part-time businesses. Doesn’t matter what you do. What matters is how much you’ve put into the business and how much you’re making.

If those two things fall within the set limits, then you’re an MSME. And once you’re under that category, you can apply for government schemes—things like easier loans, help with certifications, or support if someone delays your payment.

It’s not a badge. It’s access.

The 2025 MSME Classification

Not every business in India is a big company. Some are just starting out. Some have been around for years but operate with small teams and tight budgets. That’s where MSME classification comes in. It helps the government figure out which businesses need support—and how much.

In 2025, the government made changes to how MSMEs are identified. They raised the numbers. So now, more businesses can fit into the system and still qualify for benefits.

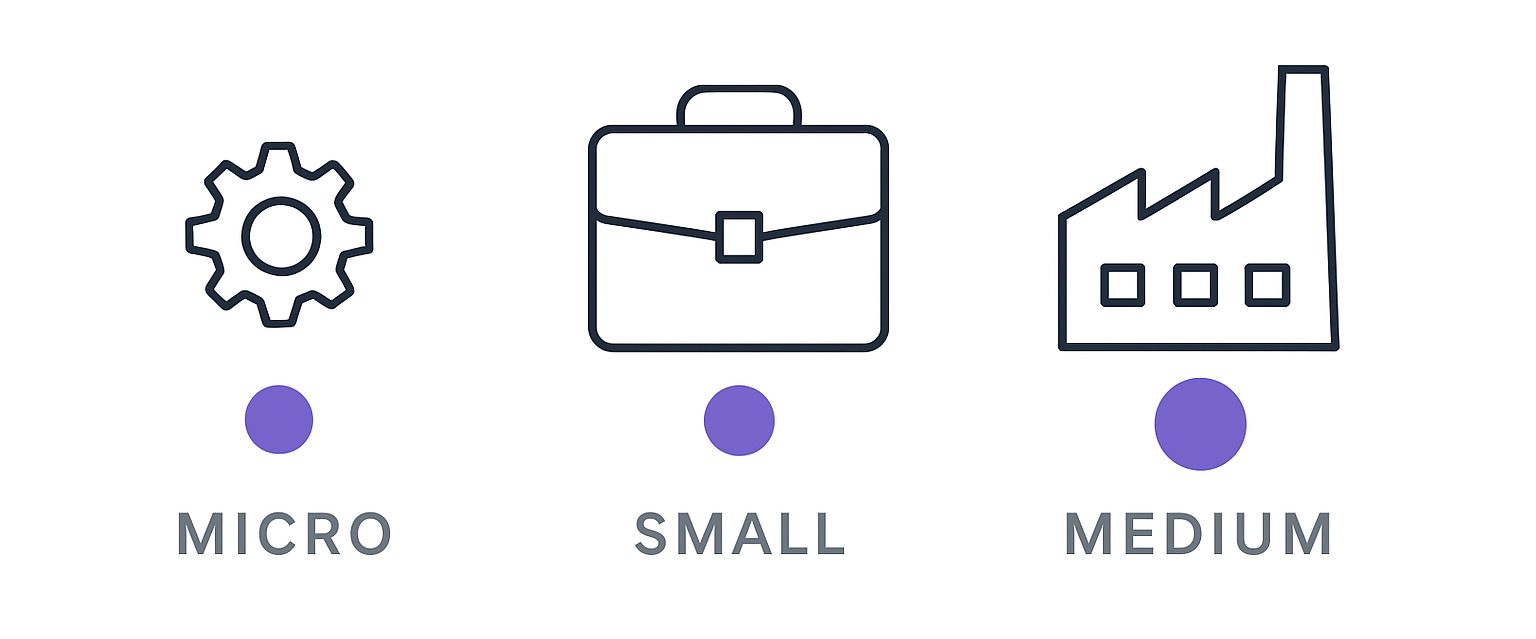

You’re placed into one of three groups: micro, small, or medium. The decision is based on how much money you’ve put into the business (mostly in equipment or setup), or how much you make in a year. You don’t have to meet both. Just one is enough.

Here are the new figures:

- If you’ve invested up to ₹2.5 crore or earn up to ₹10 crore in turnover, you’re considered micro

- If your investment is up to ₹25 crore or turnover is up to ₹100 crore, you’re small

- And if you’ve invested up to ₹125 crore or make up to ₹500 crore, you’re medium

The old rules had much lower limits. A medium business was capped at ₹50 crore turnover before. That’s now ten times higher.

This change is meant to help growing businesses keep access to support while they scale. You don’t get kicked out of the system just because you’re doing well. It gives you breathing room. And for many, that makes all the difference.

Why MSME Classification Matters for Your Business

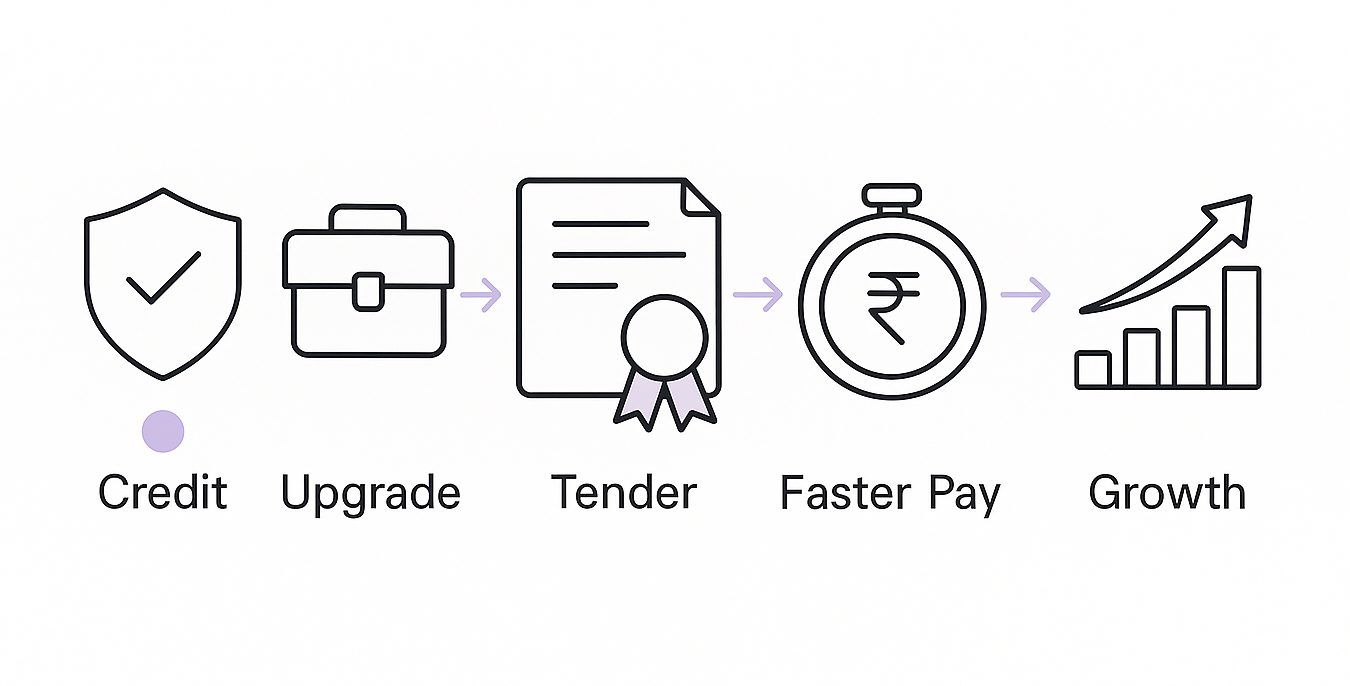

Getting listed as an MSME makes a real difference. It’s not just a government label—it affects what your business can access and how fast you can grow.

Let’s say you need a loan, but don’t have land or anything big to offer as security. If you’re registered as an MSME, banks are more likely to lend, because the loan is backed by a government guarantee. That changes things. It means you can plan growth without putting your personal property at risk.

Then there’s the question of payments. If a buyer delays payment beyond 45 days, and you’re an MSME, you’re protected. You can file a case and expect it to be taken seriously. Without registration, you’re just another vendor waiting.

You also get price advantages in government tenders. Some contracts are set aside for MSMEs only. Even when they’re not, you get special treatment—like a lower security deposit, or exemption from experience clauses.

There are other benefits too—grants for quality certification, discounts for tech upgrades, and help filing patents. But the biggest benefit? It gives you visibility. You’re no longer just running a business—you’re recognised. And that matters.

MSME vs SME vs Startup – Who’s Who?

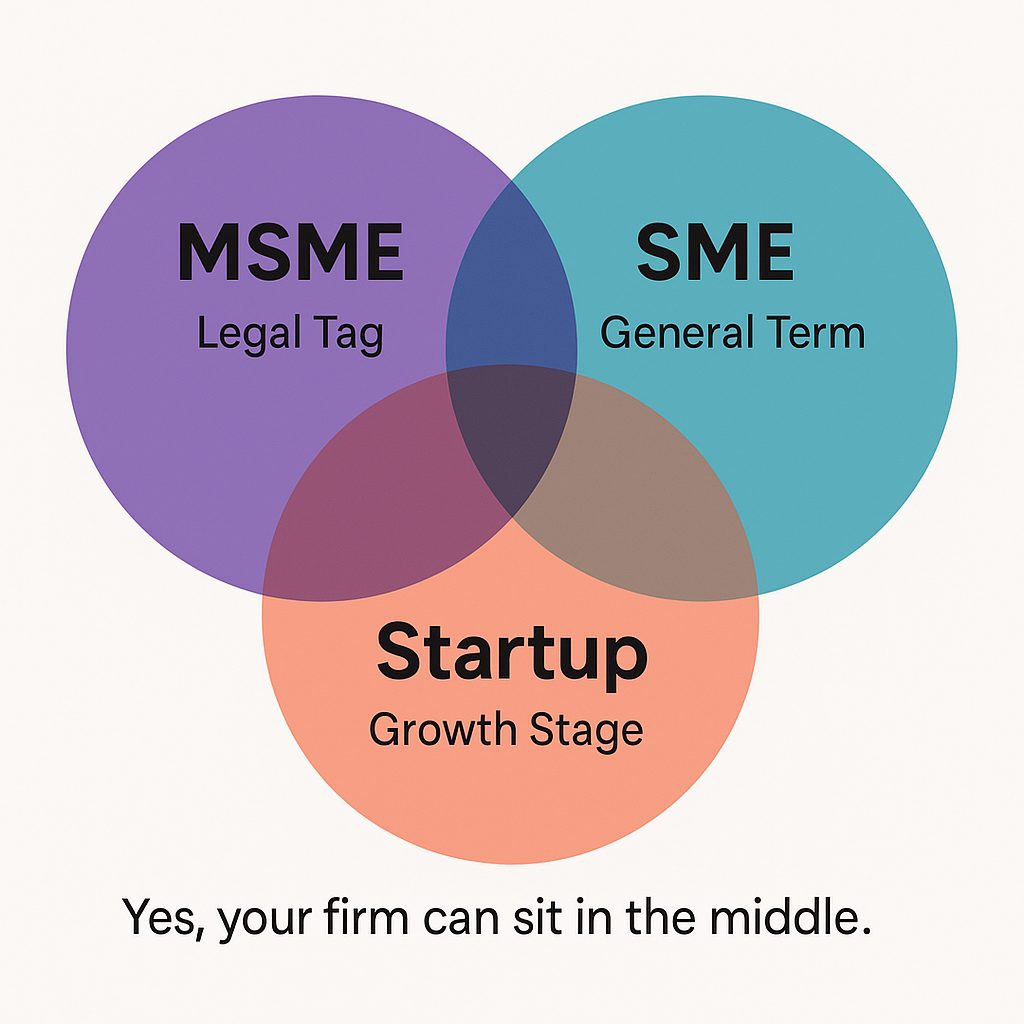

People use these terms a lot. Sometimes they mean the same thing. Sometimes they don’t. If you’re running a business, it helps to know the difference.

MSME

This one’s official. It’s used by the Indian government to classify businesses. It’s based on either how much you’ve invested in equipment or how much money your business makes in a year.

If your numbers fall under the limit, you’re an MSME. Doesn’t matter what industry you’re in. This is the tag that gives you access to schemes, benefits, and credit help.

SME

SME means Small and Medium Enterprise. It’s not an official tag in India. You won’t find a form or certificate that registers you as an SME. People just use the word in conversation or reports to talk about businesses that aren’t big.

Sometimes it overlaps with MSME. Sometimes it doesn’t.

Startup

This one’s about how new your business is and whether it’s built to grow fast. A startup might still be small in size, but it’s often trying something new, usually with tech or scale in mind.

You can be a startup and an MSME at the same time. Or you might be one and not the other. Depends on how your business looks on paper.

| Term | Is it officially defined? | Based on… | Can it overlap? |

| MSME | Yes | Investment or turnover | Yes |

| SME | No | Informal usage | Yes |

| Startup | Yes (under DPIIT) | Age, idea, growth | Yes |

That’s really it. MSME is about how big your business is. Startup is about what stage you’re in. SME is just a general term people throw around.

Knowing which one fits you best helps when filling out forms, applying for benefits, or explaining your business.

How to Register as an MSME in 2025

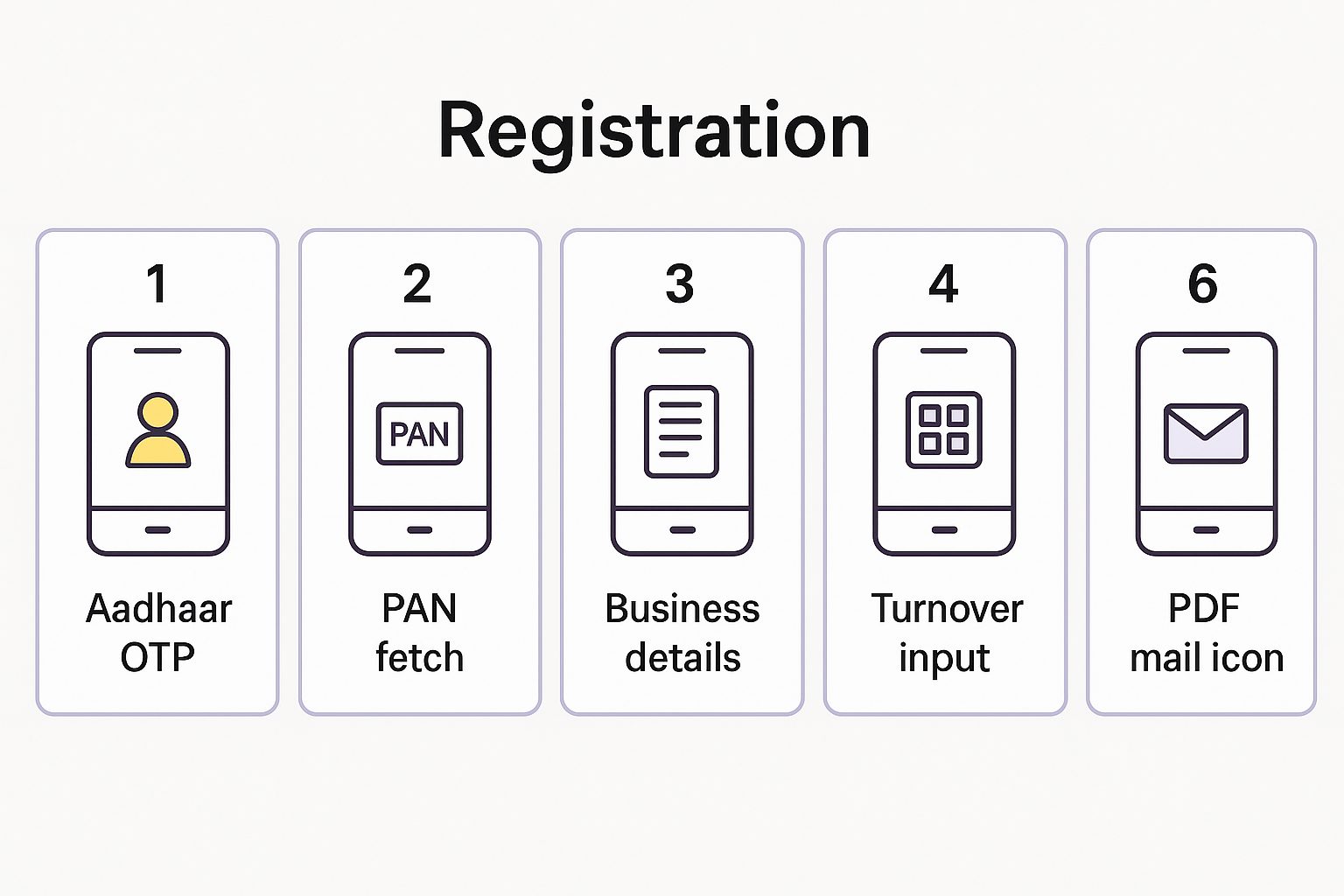

You can finish the paperwork for an MSME in a single coffee break. The whole thing sits on the Udyam website, costs nothing, and never asks you to scan a PDF. What trips people up is usually a missing link between their Aadhaar and PAN, not the form itself.

What you should have on hand

- Owner’s Aadhaar — and the phone it’s linked to (the OTP lands there)

- PAN for the proprietor, partnership, or company

- A working GST number if you collect GST

- Your business address, head‑count, and bank account IFSC

The five clicks that matter

- Type udyamregistration.gov.in into your browser—bookmark it so you don’t land on a look‑alike site.

- Hit “For new entrepreneurs”. Punch in the Aadhaar number, wait for the text message, drop the OTP, and press Validate.

- A form opens. Fill the basics: business name, trade or manufacturing flag, district, state, email, phone.

- Add the PAN and, if asked, GSTIN. Drop last year’s turnover or, if you’re new, a rough estimate. The portal knows it’s an estimate.

- Double‑check, press Submit. A fresh Udyam number pops up. Copy it somewhere safe.

After you press submit

Within an hour—sometimes minutes—a PDF certificate shows up in your inbox. Print one copy for your accounts file and forward the mail to yourself with a clear subject line so you can find it later. This single page is what lenders, tender portals, and subsidy desks will ask for.

Small but useful tips

- The portal times out; jot answers on a notepad first so you can paste if the session drops.

- If your turnover swung wildly last year, use the higher figure. Being conservative on revenue is fine for the taxman, not for this form.

- Keep the OTP phone handy; each new session needs a fresh code.

Do this once; there’s no renewal. The system pings tax databases each year and updates your status automatically, so your MSME tag grows with you until you cross the limits.

Why Signing Up as an MSME Pays Off

You’ve navigated the Udyam form, hit Submit, and a tidy PDF is sitting in your inbox. Nice; but what does that single sheet actually unlock? A surprising amount. Below is a rundown of the most useful perks owners cash in on every day. No jargon, just the stuff that moves the needle.

Loans That Don’t Demand Your Building as Collateral

Banks are usually allergic to risk. Registering as an MSME plugs you straight into CGTMSE, a government‑backed guarantee on working‑capital and term loans up to ₹10 crore. The paperwork is lighter, the approval bar is lower, and the branch manager finally has cover to say yes.

Interest Subsidies That Shave Points off Your EMI

Exporters and manufacturers can dip into the Interest Subvention Scheme—currently two to three percentage points of the rate knocked off a fresh loan. Over a three‑year repayment window, that’s real cash staying in the business instead of the bank’s ledger.

Cheaper Tech, Machinery, and Certifications

Old equipment is slow, and slow bleeds profit. The CLCSS grant pays up to ₹15 lakh toward modern plant and machinery; an extra chunk is reimbursed if you chase ISO or BIS certification. Toss in the Design and IPR subsidies and you’re saving lakhs on upgrades you meant to do anyway.

Priority in Government Buying—No Big‑Boy Muscle Needed

Central ministries and PSUs must source at least 25 per cent of certain categories from MSMEs. Some tenders waive the earnest‑money deposit and the prior‑experience clause entirely. If you’ve ever been elbowed out by a conglomerate’s balance sheet, this flips the script.

A Legal Clock on Late Payments

Under the MSME Development Act, buyers get 45 days to settle invoices—miss that, and interest starts piling up at thrice the RBI’s bank rate. File a complaint on the Samadhaan portal and the council tends to move faster than a civil court, which means liquidity back in your pocket rather than locked in follow‑ups.

Easier Entry to Trade Platforms

Platforms like TReDS let you auction approved invoices to financiers for quick cash. MSME registration is the ticket in. No more begging a buyer’s accounts team for “status updates”; you sell the invoice, pay a small discount, and move on.

Tailored Export Support

First‑time exporters get hand‑holding through Niryat Bandhu mentors, concessional ECGC premiums, and duty drawback tweaks that favour smaller consignments. Add in cheaper stalls at international trade fairs, and the leap abroad stops feeling impossible.

Crisis‑Time Lifelines

When the next slowdown hits—and it will—registered MSMEs are first in line for emergency credit lines, moratoria, and interest waivers. Pandemic, flood, commodity shock—history says the relief packages always start with enterprises on the Udyam list.

In short, the certificate isn’t a trophy to frame; it’s a key. Use it, and the doors open—credit, protection, cheaper tech, and contracts big enough to change your revenue graph. Ignore it, and you’re leaving money on the table.

Conclusion

An MSME certificate doesn’t look like much: one page, a logo, a number. Yet it rewires the way suppliers, banks, and even the government treat your firm. Loans stop feeling like favours, late payments come with a clock, and tenders you once scrolled past suddenly sit within reach.

If your turnover or investment still fits inside the 2025 limits, claim the tag and keep it handy; it costs nothing and spares you the hidden tax of being “too small to matter.” Growth is hard enough—no point leaving the easy wins on the table.

Empowering MSMEs to grow smarter

Tata nexarc delivers powerful solutions for MSMEs—discover tenders, logistics solutions, and streamline procurement. Everything your business needs, all in one place.

FAQs

Is there a fee for MSME registration in India?

Can an individual freelancer register as an MSME?

Is GST registration mandatory for MSME registration?

Can a business registered under MSME change its category later?

Does MSME registration expire?

No, once registered on the Udyam portal, the registration is valid for the lifetime of the business.

Can a startup also be an MSME?

Do MSMEs get preference in state government tenders?

Is there a penalty for false MSME registration?

Can a foreign-owned company register as an MSME in India?

Does MSME registration help in getting export incentives?

Sohini is a seasoned content writer with 12 years’ experience in developing marketing and business content across multiple formats. At Tata nexarc, she leverages her skills in crafting curated content on the Indian MSME sector, steel procurement, and logistics. In her personal time, she enjoys reading fiction and being up-to-date on trends in digital marketing and the Indian business ecosystem.

The clear breakdown of the MSME definition based on investment and turnover thresholds helps in understanding the nuances of this classification. The recent revisions to the MSME definition, especially the move to a turnover-based criteria, signal the government’s effort to make the framework more relevant to the evolving business landscape.

I really like the “Who is eligible…” and “Who is not eligible…” sections. They provide clear definitions for MSME qualification, saving business owners time.

Thats so true! you have made it really simple for us. Good one.

If my business grows, could I go from being an MSME one year to not qualifying the next? Does that mess up the government help I’m getting?

Your MSME registration will help you to grow more. It has certain benefits which you should explore. It doesn’t mess up anything.

काजू करखण्यास्थी कर्ज मंजुरी